Checklist: As a High-Income Taxpayer, How Might President Biden’s Tax Plan Affect Me? 2021

President Biden’s administration has outlined a tax policy built upon the agenda introduced during his campaign. Biden’s tax plan focuses on raising taxes on corporations and affluent households, while increasing credits for moderate- to lower-income households. With Democratic control of Congress, changes outlined in President Biden’s tax plan have an increased possibility of becoming a reality. At what time, in what form, and to what extent remains to be seen; however, another round of tax law changes is likely on the horizon.

Having adapted to frequent, and sometimes major, legislative changes in recent years (namely the TCJA, the SECURE Act, the CARES Act, and most recently, the American Rescue Plan Act), you may be understandably concerned about what changes could be imminent. High-income households, in particular, have been targeted for tax increases under Biden’s tax plan. By familiarizing yourself with President Biden’s tax plan now, you can be positioned to take action and seize planning opportunities when changes are implemented.

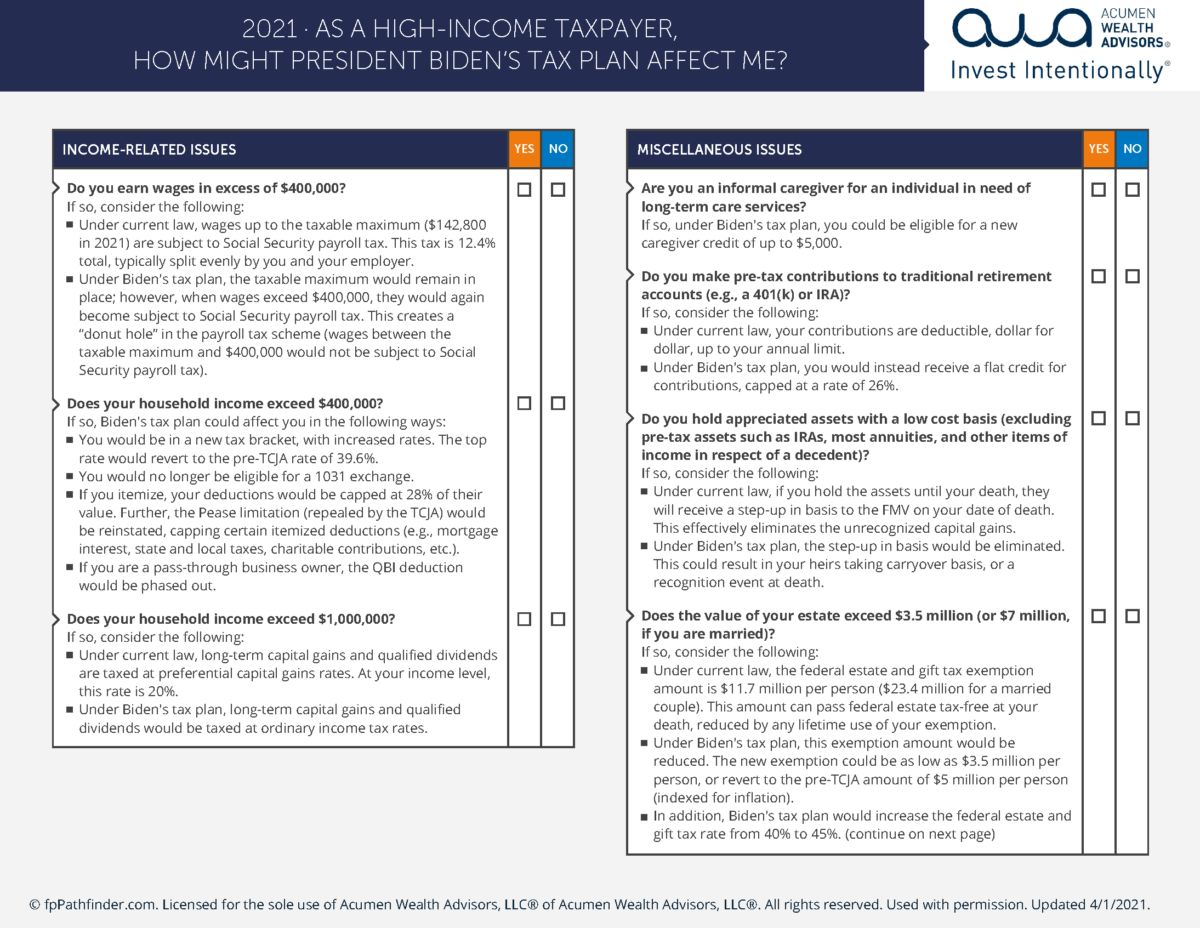

Take a look at this checklist to help guide you through conversations regarding the highlights of President Biden’s tax plan, along with the companion piece “How Might President Biden’s Tax Plan Affect Me?”.

You may find this flowchart on Acumen’s Resources page: As a High-Income Taxpayer, How Might President Biden’s Tax Plan Affect Me?

If you’d like to discuss your personal situation and learn more about how Acumen can help you Invest Intentionally®, please contact us.

This report is provided as a courtesy for informational purposes only. The information has been obtained from sources we believe to be reliable; however, no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. This information is hypothetical in nature as no tax plan has been finalized as of publication. The final tax plan could vary.

Report Not a Solicitation

Do not act or rely upon the information in this publication without seeking the services of competent and professional legal, tax, or account counsel.

Report Does Not Provide Legal, Tax, or Accounting Advice

This report does not provide legal, tax, or accounting advice. Before making decisions with legal, tax, or accounting ramifications, you should consult appropriate professionals for advice specific to your situation.

For More Information

You should seek the services of your legal and/or tax advisors when making financial decisions. It is also recommended that you visit the IRS website at www.irs.gov for additional information.

Acumen Wealth Advisors, LLC® is a Registered Investment Advisor. Advisory service are only offered to clients or prospective clients where Acumen Wealth Advisors, LLC® and its representatives are properly licenses or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Acumen Wealth Advisors, LLC® unless a client service agreement is in place.