Acumen’s Coronavirus Update: March 9, 2020

03/09/20

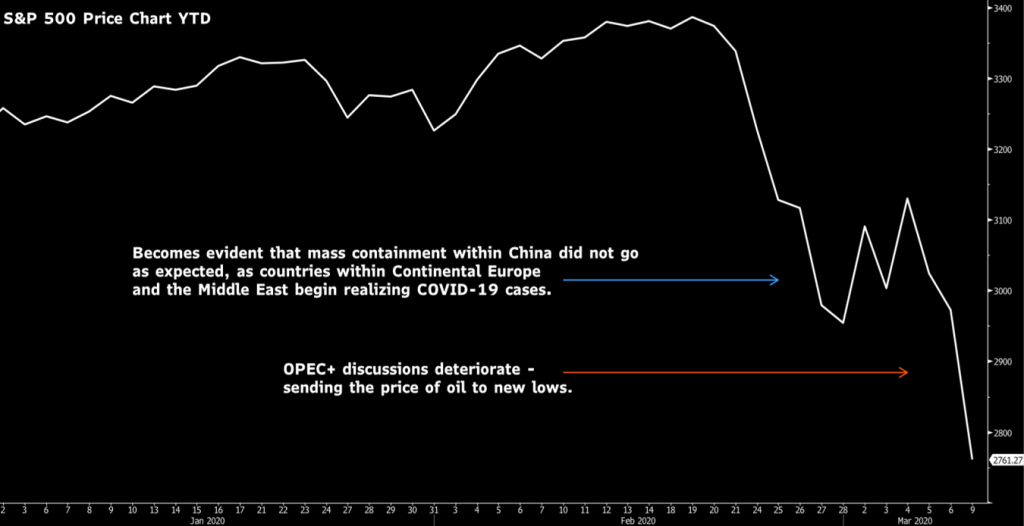

The market has recently realized extreme volatility. This began with the spreading of the Coronavirus (COVID-19) from mainland China to countries outside the Asia Pacific region such as Italy and Iran. The United States then began seeing cases of the virus come forward. The result was a -12% decline in the S&P 500 over a two-week period. This decline was followed by the breakdown of OPEC+ discussions over the weekend.

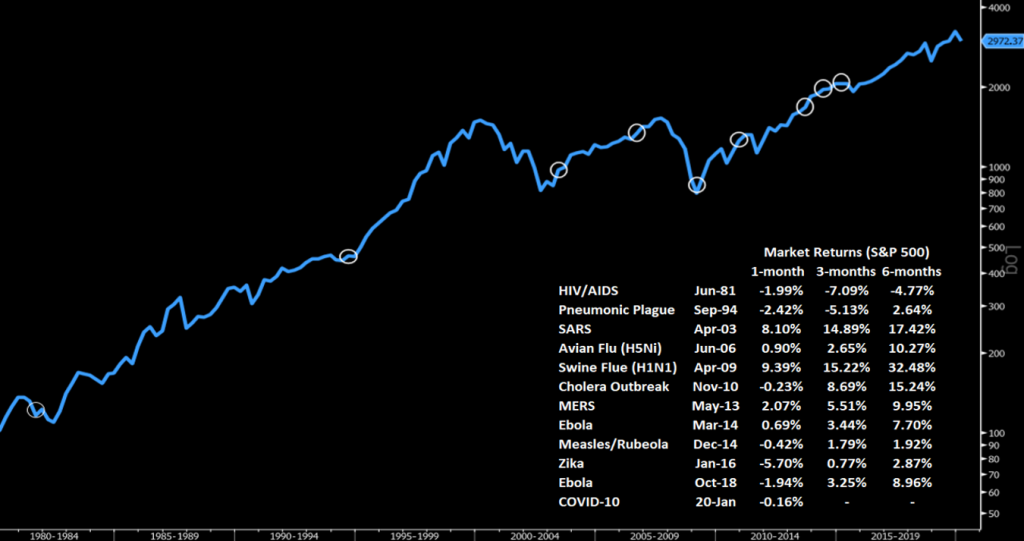

Widespread pandemics are not unlikely. In fact, they happen more often than realized. From the chart below, it is evident they effect financial markets in various and uncorrelated ways. Typically, the reaction of the financial markets to a pandemic is more related on the underlying fundamentals of the economy. For this reason, the outbreak of the Coronavirus did not allow us to model future financial market reactions based on past market reactions. Many investors would want to forecast what would happen as a result of the outbreak, and the market’s reaction to it, based on what we have seen in related periods. However, the truth is no pandemic’s effect on the financial market is dependent on another. Therefore, at this time, we are monitoring the current fundamentals of the economy, their reaction to the outbreak, and using this analysis to drive allocation changes or the absence of changes altogether.

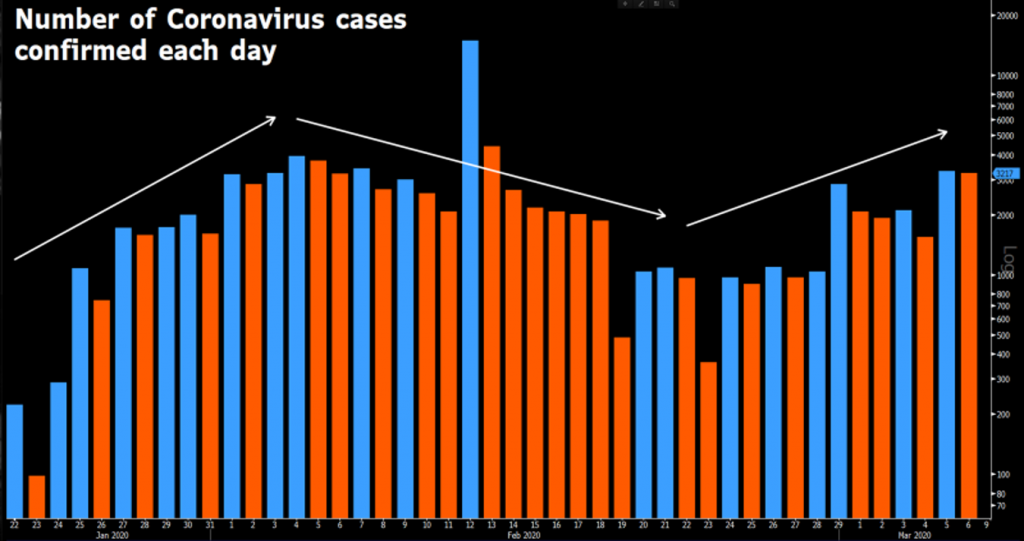

One of the primary datasets we are actively monitoring, is the rate of change within the total number of newly confirmed Coronavirus cases each day. The chart below plots this data set and the trend is noticeable when changed in either direction. A blue line reflects an increase in the number of confirmed cases from the day before, while an orange line represents a decrease. This data has been one of the primary market movers during the last two weeks. We can see where mainland China began to see a decrease in the number of cases confirmed each day. During this time, we saw financial markets react positively. However, this trend reverted quickly as countries outside of the attempted containment began to see a high number of confirmed cases. The spread began in Italy and Iran, but quickly spread to Germany, the United States, and others. The continuous rise in this measure has given us reason to hold from deploying additional capital into the equity market.

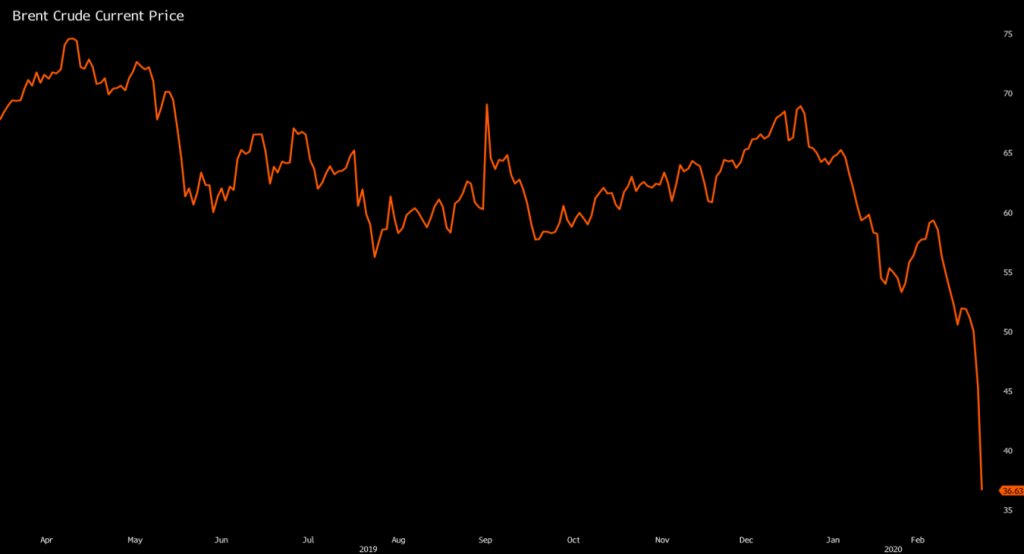

The latest surge in equity market volatility is a result of the recent deterioration in OPEC+ arrangements over this past weekend. Leaders within the oil industry attempted to come to production cut agreements to prop up the price of oil due to a demand shock created by the Coronavirus. News of the breakdown sent a massive shock through asset prices. The United States has been on the forefront of a revolution in shale production for a while now, and the massive decline in oil prices leaves many overleveraged companies within the industry further exposed to the current shock in demand. Typically, lower oil prices are good for the consumer, and sometimes the economy as a result. However, the current price war, caused by Saudi Arabia and Russia coming to terms that they will flood the market with cheap oil, will make it harder for domestic shale companies to sell at current levels, and creates the opportunity for a massive shock to the financial system.

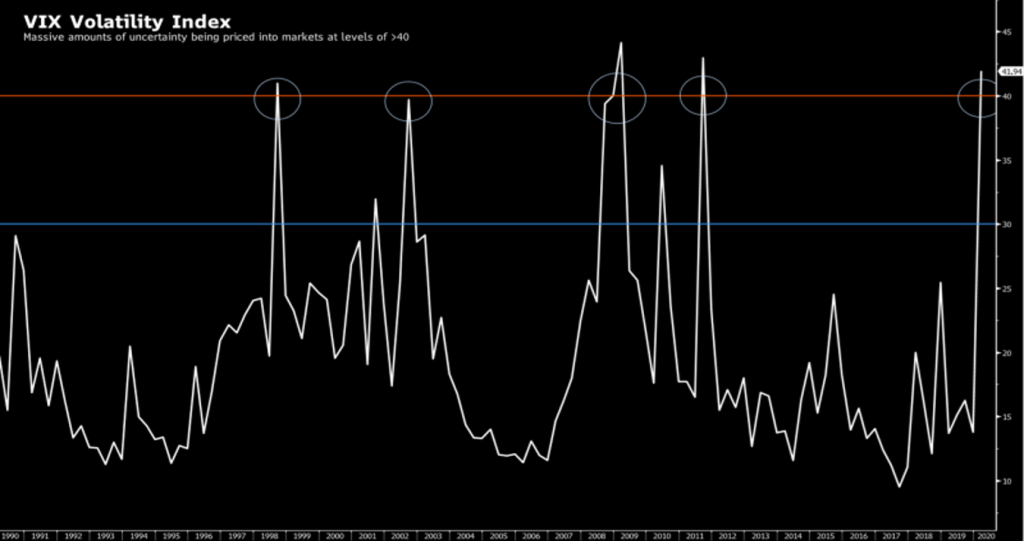

We are also monitoring the current heightened volatility the financial markets are facing due to the outbreak of the Coronavirus and the recent developments within the oil market. Charted below is the VIX, an index tracking the current expected volatility within the equity market and is often used to measure the current risk being priced into assets. VIX levels are currently at historic levels – the likes of which compare to the Great Financial Crisis, the Tech Bubble, and the European Debt Crisis. This level does not mean investors face the same outcome – it means similar levels of risk are being priced in. This volatility measure is another we are actively monitoring, since heightened volatility creating large dents in quality company share prices can create attractive buying opportunities. However, there is a trend of choppy waters during current levels, which is another reason why we are choosing to actively monitor the current risk being priced into the equity market. We remain ready to be opportunistic when we believe the level of risk being accounted for in asset prices is far greater than the reality of the situation.

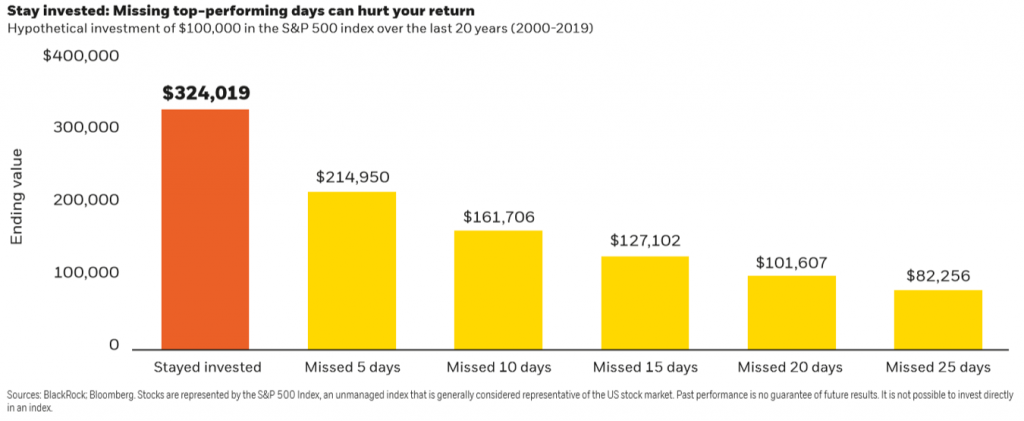

Like always, we want to continuously remind investors to remain invested in the market. We have been here before. Sure, the situation is different, but it always is. Then again, it never is. It has been proven repeatedly, attempting to time when markets will decline and rebound is an exercise in futility. Our primary goal is to remain factually objective, and to use the facts to lead us to the appropriate decision. This is why, while we actively manage asset allocation during times we feel like there could be mispricing, we will always remain exposed to the forces at play both in the Equity Market and the Fixed Income Market. This strategy has proven to produce superior long-term results while the opposite has led investors to miss out on some of the most crucial days of market exposure. On February 24th and 25th, U.S. stocks had back to back -3% trading days, which has happened a total of eight times since 1980. The average return for the 12 months following the occurrences of such volatile events was 24%. In the end, markets get behind themselves, they find themselves, and then they get way ahead of themselves. Normally, the hardest part is we only realize the market has gotten ahead of itself in retrospect. Half of those who attempt guessing when the market has gotten ahead of itself, or when it is about to find itself again, will get it wrong. The other half will get it right. Financial markets will always be bilateral. Half of the formula is demonstrated in the graphic below. The other half can be seen in the High-Quality investments we prefer to place in portfolios. So, the most valuable skill an investor can have is to remain objective to the facts and use them to determine the future course and the most appropriate formula for success.

To learn more about how Acumen can help you Invest Intentionally®, please contact us.

Grant Allen, Portfolio Analyst

About the Author: Grant Allen is a Portfolio Analyst for Acumen Wealth Advisors in Chattanooga, TN. Grant holds a Bachelor of Science in Finance-Investments from the University of Tennessee at Chattanooga’s Gary Rollin’s College of Business and has successfully passed Level One for the Chartered Financial Analyst® (CFA®) designation. The CFA® consists of three levels of exams, each requiring a recommended 300+ hours of study, minimum of four years of work experience, and multiple letters of recommendation. Exams cover Quantitative Methods, Economics, Financial Reporting and Analysis, Portfolio Management, Wealth Planning, and Ethics.

Information used in this commentary, and the first five charts, was obtained via Bloomberg L.P as of March 9, 2020.

Any charts, graphs, and descriptions of investment and market history and performance contained herein are not a representation that such history or performance will continue in the future or that any investment scenario or performance will even be similar to such chart, graph, or description.

The S&P 500 Index is widely regarded as the best single gauge of the U.S. equities market. The index includes a representative sample of 500 leading companies in leading industries of the U.S. economy. The S&P 500 Index focuses on the large-cap segment of the market; however, since it includes a significant portion of the total value of the market, it also represents the market.

OPEC (Organization of the Petroleum Exporting Countries) is an organization, founded in 1960, of nations that export large amounts of petroleum: formed to establish oil exporting policies and set prices.

Brent Crude is a major trading classification of sweet light crude oil that serves as one of the two main benchmark prices for purchases of oil worldwide, the other being West Texas Intermediate.

The opinions expressed in this commentary should not be considered as fact. Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation. Comments concerning the past performance are not intended to be forward looking and should not be viewed as an indication of future results. Diversification does not protect against loss of principal.

Acumen Wealth Advisors, LLC® is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Acumen Wealth Advisors, LLC® and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Acumen Wealth Advisors, LLC® unless a client service agreement is in place.