Acumen’s Q1 2020 Market Commentary

04/16/20

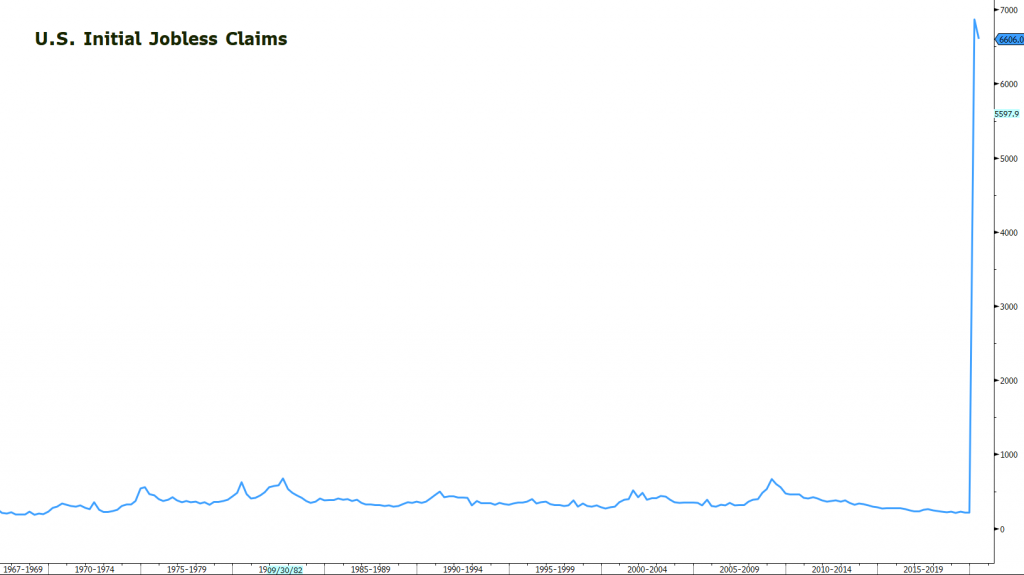

What Happened

So far, 2020 has been a complete wild card. You may remember our commentary reflecting on the previous year and our expectations for this one. We mentioned equities and other assets seemed “fully priced” at the time as a result of a 12-year economic expansion and historically low interest rates. We also mentioned investors should expect 2020 to follow a totally different narrative while not expecting similar returns as asset valuations had already been seemingly stretched over the previous 12 months on the hopes of a more profitable 2020. The unravelling of a virus, centered around a single location on lockdown to a global pandemic, has now produced a global economic shutdown – leading us to a truly unprecedented time in history. This first quarter brought us recessionary-era-like economic data, such as ten million initial jobless claims during the last two weeks of March, and an updated unemployment rate matching 2017 levels (not including the last two weeks of jobless claims). Throughout the same timeframe, financial markets displayed the fastest 20% correction in equity prices, produced all-time low yields across treasuries, and showed dislocation across historically fragile markets like High-Yield Debt. The 15% rally during the final week of the quarter reflected the forward-looking nature of financial markets and the perspective of a future reversion to normalcy in the medium term. Ultimately, the rally left investors confused to how markets would interpret our current state moving forward. We believe it’s important to call it what it is – a screeching halt in the global economy – something we truly have never seen before. This time IS ACTUALLY DIFFERENT.

What to Expect

Because of the abnormal nature, we will continue to learn from the events of the first quarter and in the future. Analysis of an event and its effects in advance of its end can provide great insight into what we are likely to see in the future, and more importantly, how to handle these events. Using what we know, there are a few fundamentally educated predictions worth making at this time regarding the economy and the way the financial markets will react moving forward. We believe it is of utmost importance to have a plan while, at the same time, acknowledging we can’t be entirely sure what the future holds. Having a plan allows us to tactically manage exposure to risk and dislocations creating opportunities.

Since the very beginning of the outbreak of COVID-19, pundits and economists have attempted to describe the pending economic recovery by using letters. Toward the beginning of the slowdown, the “V’ was thrown around the most – implying we will see a sharp decline and a similar recovery. When recovery seemed to become much more complicated, we heard the “U”, meaning it would take longer for the recovery to find its footing, but when it did, we would be full steam ahead. The truth is nobody knows for sure. Anything but an educated guess using fundamental data and analysis is time not-so-well wasted. We will most likely see more unpleasant economic data in the weeks to come. As companies continue to layoff and furlough employees, the labor market data should continue to surprise on the negative side – likely lead to a continuation of fiscal and monetary policy the likes of which we have never seen and greater Debt-to-GDP ratios than we’ve seen historically. As a result, subdued inflation will likely make its return.

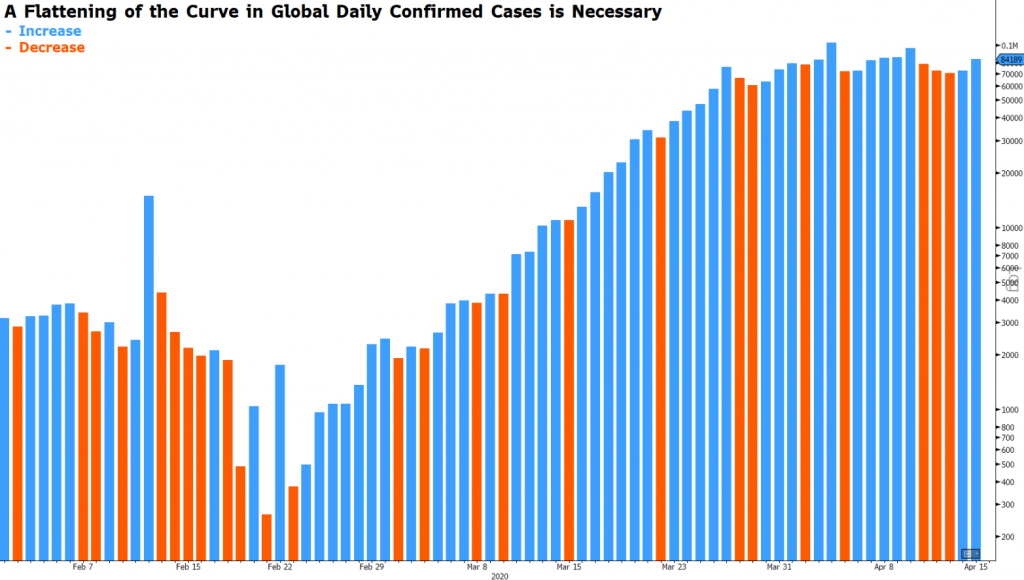

During the coming months, we prefer to keep investors conservatively positioned relative to their allocation goals as we believe the unknown risks being presented negatively skew the short-term outlook. The approach moving forward and the tactical shifts we made during the first quarter can be highlighted by a greater allocation to cash and far less exposure to emerging economies, international small cap equities, and high-yield fixed income. However, we also prefer to keep ourselves from attempting to time the market. Instead, we expect to adhere to proven strategic asset allocation and use fundamentals and what we know to make tactical shifts wherever we see dislocations or opportunities. Using historic financial market corrections and events, we know rallies within bear markets north of 20% are typical, similar to the one we witnessed during the last week of the quarter. We believe the possibility of another leg down in the short-term is high, given the likelihood we see no immediate dent in the curve of daily infections from the Coronavirus, a continued deterioration in the labor market, and tightening credit conditions for already over-leveraged companies. What we currently favor are equities of companies with:

- Extremely high-quality balance sheets;

- High investment grade fixed income where we believe spreads will tighten from here on out after the dislocation we saw in March; and

- Low-beta assets like gold providing essential diversification during corrections.

We are likely to remain conservative and value-focused until we believe the fundamentals seem favorable.

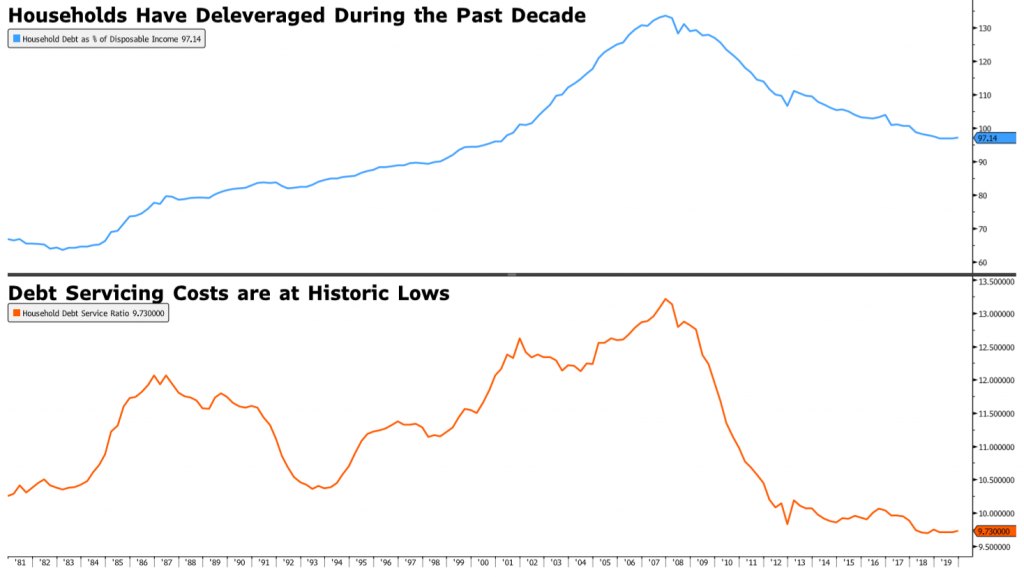

While we can’t predict a perfect timeline, we are certain there will be a recovery. It’s natural to look to brighter days, and it’s the market’s job to do the same. However, as murky as the short-term seems, we believe the most likely scenario for an economic recovery will come in the shape of a “Y”. A quick reversion to where we were is unlikely, but there will be reversion to something more ‘normal’ than what we are currently experiencing. Part of our confidence in the certainty of reversion is the strength of the consumer. Since the previous recession, household debt, as % of disposable income, has fallen to levels not seen since the early 2000s and debt servicing costs are at historic lows. The current fiscal and monetary responses should also likely protect a seemingly strong consumer base from more serious implications. We also see much more strength in the fabric of the global economy’s financial system – partly represented by high quality capital ratios. Then, we will, more than likely, find newer and better methods going forward and continue the next expansion at a much more moderate pace. During these times, we expect a few longer-term secular trends to take precedence. For instance, where we were once constructive on emerging economies, we believe the agenda of deglobalization will be further heightened when we reach the other side of current events, which pose greater risk for these areas. We will also monitor the fundamental outlook for small cap equities, as the current economic downturn will likely weed out those companies having exposed themselves to over-leveraging in the last few years of historically low borrowing costs followed by a sudden stop in demand.

Our Thoughts

It’s highly likely most everyone who is reading this right now is at home, with their children or family, doing their best to be a mom and dad, a co-worker, a teacher, or a small business owner. Whatever you are doing, we are sure it has been dramatically altered by our current state of affairs. Many think the events transpired through the first quarter marks the end of not just an era, but of many eras. The analysts believe the way we have done things for the last century will be dramatically altered to introduce new ideas. Offices full of co-workers are now empty, with most working from home, and this is foreseen as the new way. Those same analysts believe we will come out of a government-imposed quarantine and the law of forced space between us will become the norm. However, we believe the exact opposite will occur. eSports will not replace having a hot-dog with your buddies at the baseball game. Internet schooling will not replace K-12 in-person schooling where children aren’t only educated in literature and science but in better ways to interact with one another. Instead, we have hope the way we have done things for so long are not replaced by social-distancing norms, but as refined versions of themselves. Throughout history, when the incentive to advance becomes survival, literally or even financially, we see the greatest advancements. For example, the period of 1929 – 1941, the era of the Great Depression and the start of World War II, is sometimes looked at as our most technologically progressive of all. The Great Depression brought unimaginable financial pain, but also supermarkets, sunscreens, and electron microscopes. The point is, people didn’t stop shopping or searching for scientific advancements due to the times, but instead, found greater ways to prosper. People need people and interaction. We always have and we always will. Our connection with others has driven us out of so many crises, and we believe our relationships will do the same again. For this reason, we remain hopeful and optimistic about where we will be when we write this update in 2021. We have found history remains kind to those who attempt to strive during crisis. We hope we will soon see the flattening in the curve of people contracting this infection daily, so we can begin to relive what we once thought of as normal.

To learn more about how Acumen can help you Invest Intentionally®, please contact us.

Grant Allen, Portfolio Analyst

About the Author: Grant Allen is a Portfolio Analyst for Acumen Wealth Advisors in Chattanooga, TN. Grant holds a Bachelor of Science in Finance-Investments from the University of Tennessee at Chattanooga’s Gary Rollin’s College of Business and has successfully passed Level One for the Chartered Financial Analyst® (CFA®) designation. The CFA® consists of three levels of exams, each requiring a recommended 300+ hours of study, minimum of four years of work experience, and multiple letters of recommendation. Exams cover Quantitative Methods, Economics, Financial Reporting and Analysis, Portfolio Management, Wealth Planning, and Ethics.

References: All Charts and data are obtained from Bloomberg as of 3/31/2020.

The opinions expressed in this commentary should not be considered as fact. All opinions expressed are as of the published date and are subject to change. Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. Investments in securities involves risk, will fluctuate in price, and may result in losses. The information has been obtained from sources we believe to be reliable; however, no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation. Comments concerning the past performance are not intended to be forward looking and should not be viewed as an indication of future results. Diversification does not protect against loss of principal.

Any charts, graphs, and descriptions of investment and market history and performance contained herein are not a representation that such history or performance will continue in the future or that any investment scenario or performance will even be similar to such chart, graph, or description.

Acumen Wealth Advisors, LLC® is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Acumen Wealth Advisors, LLC® and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Acumen Wealth Advisors, LLC® unless a client service agreement is in place.