Acumen’s Q2 2019 Commentary on the Equity Market

Despite being the longest expansion on record, the S&P 500 has risen approximately 20% as of July 15, 2019. This market movement upward comes on the heels of a volatile fourth quarter where the S&P 500 ended down 13.5% (www.bloomberg.com/quote/SPX:IND?in_source=topQuotes). Now, investors in the equity market seem to be split into polarizing camps between those who believe we experienced the bottom in December, and those who think the next recession is looming as the Fed and current political movements are only prolonging a more severe pullback. We believe there are returns one can generate with a foot in both camps. A rally may lie at the end of this bull market. We continue to review economic indicators and attempt to position investors to prepare them for the potential that this rally may not last a significant amount of time.

Fed Chairman Powell’s comments about the case for lower interest rates due to strengthening downside risks in the U.S. economy caused investors to quickly send indexes to all-time highs. A short-term sense of optimism about equity prices is supported by this type of fiscal policy pivot, but we should remain cautious of the long-term outlook.

A yield curve inversion occurs when long-term interest rates are lower than that of short-term interest rates. On July 1, 2019 the Treasury yield curve inverted when the 3-month yielded 2.21% and the 10-year yielded 2.03% (www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yield). The inversion of this curve should be looked at as a sign of caution. As Samuel Clemens once warned, “History doesn’t repeat itself, but it often rhymes.” The progression from this type of fiscal policy pivot to the next recession is a pattern which investors must be prepared for.

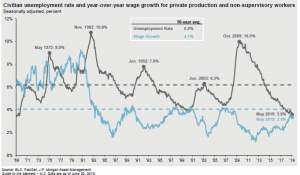

Investors quickly became cautious after the latest US Department of Labor jobs report. June 2019’s headline number showed 224,000 jobs were added to the U.S. economy leaving the unemployment rate barely changed at 3.7%, shattering expectations. This led investors to believe the Fed may not actually cut rates just yet, as signs of economic weakness were not too drastic, causing equity prices to sink back below the highs we saw during the prior week. However, we believe there are two weak spots that can be seen in the latest jobs report, which could signal less economic strength than the headline numbers are indicating. According to the latest report, average hourly earnings went up by only 0.2%, as opposed to the 0.3% that was expected. Also, the number of people who are working multiple jobs increased by 301,000, the greatest monthly increase since July 2018. When we compare these two statistics with the 224,000 jobs created, we get a different picture of our employment situation (www.bls.gov/news.release/empsit.nr0.htm). Yes, the U.S. is still creating jobs, but they don’t seem to be great jobs, as average wages are remaining somewhat stagnant and workers are having to hold multiple jobs for support.

The current equity market paints a perfect picture of two conflicting viewpoints. Investors love the idea of a rate reduction, but they don’t want to see economic weakness. Economists are looking more bullish, but it seems as if that group has predicted nine out of the last five recessions. For this reason, allocating to equities that have steady cash flow in the form of dividends seems to be a prudent investment and one we have supported and increased exposure to over the last quarter. Our strategy is one of participation with a focus on yield and shield. We remain focused on economic indicators but maintain our client portfolios should be allocated defensively, while maintaining exposure to the equity market in order to have the ability to capture returns in this record-setting bull market.

Regards,

The Acumen Portfolio Management Committee

S&P 500 Index is widely regarded as the best single gauge in the U.S. equities market. The index includes a representative sample of 500 leading companies in leading industries of the U.S. economy. The S&P Index focuses on the large-cap segment of the market; however, since it includes a significant portion of the total value of the market, it also represents the market. All indexes are unmanaged and an individual cannot invest directly in an index. Index returns do not include fees or expenses. Any charts, graphs, and descriptions of investment and market history and performance contained herein are not a representation that such history or performance will continue in the future or that any investment scenario or performance will even be similar to such chart, graph, or description.

Acumen Wealth Advisors, LLC® is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Acumen Wealth Advisors, LLC® and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Acumen Wealth Advisors, LLC® unless a client service agreement is in place. Comments concerning the past performance are not intended to be forward looking and should not be viewed as an indication of future results. Diversification does not protect against loss of principal. The opinions expressed in this commentary should not be considered as fact. Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however, no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. It is suggested you consult your financial professional, attorney, or tax advisor with regard to your individual situation.