Acumen’s Q4 2016 Market Insights Commentary: Welcome 2017!

Let us welcome the New Year, give the happy adieu to the old, start the new beginning without fear, and cherish the memories we hold.” Author Unknown

Adieu 2016; you were one of the most eventful years for investors since 2008!

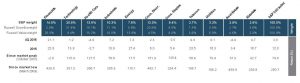

2016 began with a turbulent opening based primarily on fears regarding China and rising interest rates. From December 31st to February 11th, the S&P 500 fell 10.51% and the NASDAQ dropped 14.79% (Yahoo). Neither of those concerns garnered a strong foothold through the year. Next, the market seemed to shift focus to politics with significant distractions. Initially, Britain voted for Brexit, then Italy voted against constitutional reform, and, finally, the United States voted for Donald Trump as 45th President with a Republican Senate and House of Representatives. Despite the global political uncertainty, when the dust finally settled, the S&P gained 12%, well above the International Stocks up only 1.5% (MSCI EAFE) and fixed income up 2.6% (Barclays Agg.).

*Chart Disclosures on Page 2

Welcome 2017; it may be a new year, but we predict more of the same. Increased political disruptions causing volatility with continued strengthening of economic fundamentals.

The stock market may continue the upward trend bolstered by fiscal policy, Trump initiatives, and consumer sentiment. All of these factors would increase the potential for growth and strengthen the US economy. Our view is the economy is good and improving. We have seen a reduction in unemployment and now we are seeing upward wage pressure. Nonetheless, we expect heightened volatility as a result of political noise, protectionism, and less trade-friendly policies globally.

Market Insights

The populist agenda, which led Donald Trump to win the presidential election, expands beyond the US borders. Upcoming elections in the Netherlands, France, and Germany will reveal how the populist forces gain ground against the European Union and the Euro. The anti-trade populism across the developed world is concerning; higher tariffs could hurt global economic growth. The negative political outlook reminds us of 2012. Readers may recall the European Union was on the edge of collapse, our government almost defaulted on our debt payments, and our economy had anemic growth. Despite these challenges, the S&P returned 29.6% the following year (Source: Yahoo Finance).

Trump’s policies appear to be pro-business. It is no surprise small business sentiment is improving. Potential corporate tax cuts could lead to repatriation of funds resulting in higher dividends, share buy backs, capital spending, and mergers/acquisitions. The potential of replacing the Affordable Care Act could result in business expense savings. Financial and environmental deregulation could be beneficial for the finance, energy, material, and industrial sectors. These factors could be beneficial to earnings, the “E” of P/E ratios.

There is some concern the recent appreciation in stock prices, the “P” of P/E ratios, has left valuations feeling a bit stretched. Increased earnings could help ease this concern.

Increased infrastructure and defense spending could spur economic growth but also apply upward pressure on wage growth. Paying for increased spending and decreased tax revenue must come from additional federal borrowing. Coupled with Federal Reserve fiscal tightening and rising interest rates, this action could lead to inflation. Fed Chair Janet Yellen has indicated the interest rates will increase slowly and should not cause additional economic challenges in 2017. We recently joined many others who have slowed the deployment of funds into long-term debt. Our fixed income strategy favors a shortening duration, a focus on credit, and the addition of securities to help mitigate the risk of inflation.

Acumen Wealth Advisors’ investment strategy has long centered on large capitalization dividend growth stocks. We see dividend growers, companies with sustainable free cash flow and the ability to raise their dividends over time, as most resilient in a rising rate environment. When interest rates are increasing based on improving growth outlook, the stock market can still do well. At the firm level, we have also begun the year with increased purchases of international equity. Europe is continuing on a path of slow but steady growth and Japan is stabilizing. China’s growth has slowed but is still expanding. Improvements in the commodity cycle are favorable for economies such as Brazil and Russia. We don’t foresee the strengthening of the US dollar continuing at the same velocity.

Sir John Templeton once said, “Bull markets are born on pessimism, grown on skepticism, mature on optimism and die on euphoria.” Increased investor optimism is also playing a part in lifting equities. Although the Dow has hit record highs since the US presidential election, we see few signs of a bubble. There doesn’t appear to be the same risk taking and irrational exuberance present in the run-up to the dot.com bust and 2008 financial crisis yet. Acumen Wealth Advisors takes a rational, not emotional, approach to investing. Part of our role is to maintain a disciplined investment management approach that can, at times, capitalize on pricing inequities in the market. We fundamentally believe the essentials of investing remain asset allocation, diversification, rebalancing and staying invested. Please feel free to reach out to us if you have any questions.

Beth Tremaine

Page 1 Chart Source: FactSet, Russell Investment Group, Standard & Poor’s, J.P. Morgan Asset Management. All calculations are cumulative total return, not annualized, including dividends for the stated period. Since market peak represents period 10/9/07 –12/31/16. Since market low represents period 3/9/09 – 12/31/16. Correlation to Treasury yields are trailing 2-year monthly correlations between S&P 500 sector price returns and 10-year Treasury yield movements. Forward P/E ratio is a bottom-up calculation based on the most recent S&P 500 Index price, divided by consensus estimates for earnings in the next 12 months (NTM), and is provided by FactSet Market Aggregates. Trailing P/E ratios are bottom-up values defined as month-end price divided by the last 12 months of available reported earnings. Historical data can change as new information becomes available. Note that P/E ratios for the S&P 500 may differ from estimates elsewhere in this book due to the use of a bottom-up calculation of constituent earnings (as described) rather than a top- down calculation. This methodology is used to allow proper comparison of sector level data to broad index level data. Dividend yield is calculated as the next 12-month consensus dividend divided by most recent price. Beta calculations are based on 10-years of monthly price returns for the S&P 500 and its sub-indices. Betas are calculated on a monthly frequency over the past 10 years. Past performance is not indicative of future returns. Guide to the Markets – U.S. Data are as of December 31, 2016.

Acumen Wealth Advisors, LLC® is a Registered Investment Adviser. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation. Advisory services are only offered to clients or prospective clients where Acumen Wealth Advisors, LLC® and its representatives are properly licensed or exempt from licensure. Investing involves risk and possible loss of principal capital. No advice may be rendered by Acumen Wealth Advisors, LLC® unless a client service agreement is in place. Comments concerning the past performance are not intended to be forward looking and should not be viewed as an indication of future results. Using asset allocation or diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.