Russia & Ukraine Commentary

Thoughts of the Portfolio Management Team on the Russia and Ukraine Conflict

Overview of the Conflict

Over the last few months, Russia has built a large military force of approximately 150,000 to 200,000 troops and heavy military equipment around Ukraine’s border. The United States and its allies proceeded to warn Russia there would be severe repercussions of a Ukraine invasion. Russia denied the idea they were going to invade Ukraine. However, shortly after, they presented detailed security demands to the West. One of these demands was Ukraine or other former Soviet nations could never join NATO. Given NATO has an “open-door policy,” the United States stated this wasn’t possible.

Although Russia has repeatedly stated it would not invade Ukraine, it is important to note two regions, Donetsk and Luhansk, declared “independence” from Ukraine in 2014. These two regions have a long history of Russian-backed rebels versus the Ukrainians since 2014. As of February 21, 2022, Russia declared these two regions independent states and gave a fiery speech about Ukraine’s developing security relations with the West. In stating they were independent states, he proceeded to order troops into the pro-Russian regions of eastern Ukraine for “peacekeeping” reasons.

Many world leaders strongly opposed this move and the U.S., alongside allies, have quickly imposed economic sanctions, moved additional troops in NATO territories surrounding Ukraine, and closed a big pipeline project. Biden recently stated, “He’s (Putin) setting up a rationale to take more territory by force,” and “This is the beginning of a Russian invasion of Ukraine”.

As of February 23rd, further escalation included cyberattacks on Ukraine’s Parliament’s website, additional Russian forces entering the independent states, and a larger military presence around Ukraine’s border. At 10 PM EST, February 23rd, Russia had officially invaded Ukraine. This came after Vladimir Putin delivered a speech in which he said Ukraine is Russia’s “historical territory”. Immediately after the speech, rocket attacks began on Ukraine’s capital, Kyiv, as well as other large cities in the country.

Portfolio Implications

We entered 2022 with underweight equity market risk in client portfolios. This strategic move was accomplished through a slight underweight of equities as an asset class, but also underweight equity beta. We believed there was a high probability volatility would be much greater in 2022 than previous years because of slower economic growth and more restrictive policy due to higher inflation.

It is often impossible to accurately predict where geopolitical conflict will head, and we are of the opinion that once we do, it is likely priced into financial markets. Instead, we believe it is important to have an action plan with an array of possible outcomes and understand what the portfolio implications are for each.

Throughout history, we have seen the lead up to conflict introduce volatility to financial markets, but a recovery in asset prices long before the conflict is over. Riding out the initial volatility coming from geopolitical conflict has typically been a good strategy over the long term. History has shown just one year after most conflict-induced selloffs, equity markets have risen. This conflict could have more severe implications than past because of the current economic environment. This conflict starts at a point where we are seeing higher inflationary pressures than we have seen since the 1970s and a shift to restrictive policy as a result.

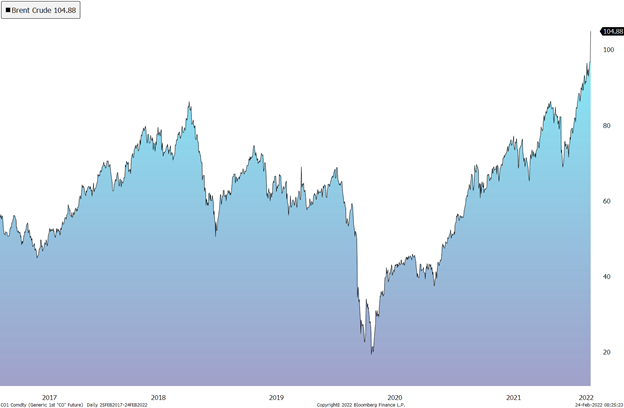

If it becomes clear this conflict will persist for some time, we could see the Federal Reserve adopt an even more hawkish approach to monetary policy as inflation expectations would likely move even higher, which would have negative implications on riskier assets like stocks. We can already see the reaction in major commodity markets such as oil (Figure 1). The other outcome is this conflict could subside very quickly. If this happens, then we believe we will return to the environment we saw going into the year – more restrictive policy and high but slowing growth. In either circumstance, we stick to our original outlook that financial markets will face higher volatility in 2022 and are prepared to manage portfolios accordingly.

Please feel free to reach out regarding any questions you may have.

Your Acumen Team

Information used in this commentary was obtained via Bloomberg L.P.

The opinions expressed in this commentary should not be considered as fact. All opinions expressed are as of the published date and are subject to change. Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. Investments in securities involves risk, will fluctuate in price, and may result in losses. The information has been obtained from sources we believe to be reliable; however, no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation. Comments concerning the past performance are not intended to be forward looking and should not be viewed as an indication of future results. Diversification does not protect against loss of principal.

Any charts, graphs, and descriptions of investment and market history and performance contained herein are not a representation that such history or performance will continue in the future or that any investment scenario or performance will even be similar to such chart, graph, or description.

Acumen Wealth Advisors, LLC® is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Acumen Wealth Advisors, LLC® and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Acumen Wealth Advisors, LLC® unless a client service agreement is in place.