Special Purpose Acquisition Companies (SPACs)

I. What is a SPAC?

A Special Purpose Acquisition Company (SPAC) is a shell company with no actual commercial operations created solely to raise capital through an initial public offering to acquire a private company. Sponsors are required to acquire a company within a two-year span (additional year may be added given permission by SEC/investors). Following the acquisition of the targeted company, the SPAC symbol is retired, replaced by the now public company on the stock market.

SPACs are formed by a sponsor or experienced management team who possess expertise in a certain industry or business sector with intention to pursue deals in a selected area. However, typically the sponsors are NOT obligated to a specific field unless stated in the disclosure. The management team or sponsor has nominal invested capital translating into ~15% to 20% interest in a SPAC. The remaining 80% to 85% is open to public shareholders through units, or common stock, and a fraction of a warrant.[1]

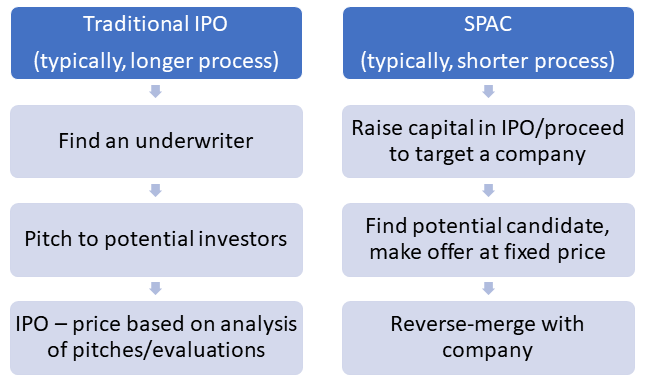

II. SPAC versus Traditional Initial Public Offering (IPO) – Simplified

The traditional IPO process requires immense efforts to implement. The company begins by finding the most suitable underwriter for the IPO which involves many meetings. Next, executives travel to potential investors to assess demand and other factors for their IPO. As previously stated, this is a tiring process for executives, in addition to still having daily responsibilities for their company.

Through a SPAC, the sponsor(s) approaches the company, and does most of the work for them resulting in less work for the private company.

III. Initial Business Combination

The initial business combination is an important phase for an investor as the SPAC changes from essentially a “trust fund” to a functioning company. If it is disclosed the SPAC is required to acquire shareholder approval, it will provide a proxy statement. Shareholders of the SPAC can vote on approval or redeem their shares. If a shareholder decides to redeem their shares, it is the pro rata amount of funds in the escrow. For example, if the IPO is ~$10, and the shareholder bought 100 shares at $20, the share of the trust account is $1,000, not $2,000.

IV. Current Environment

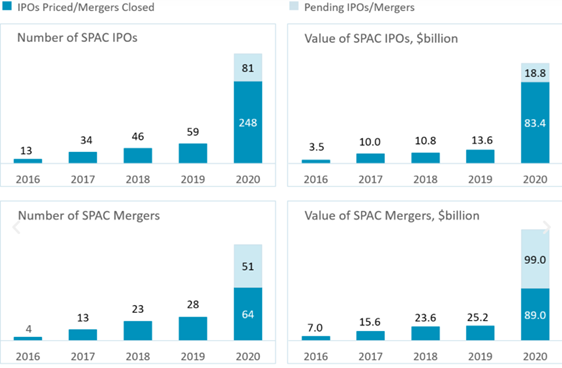

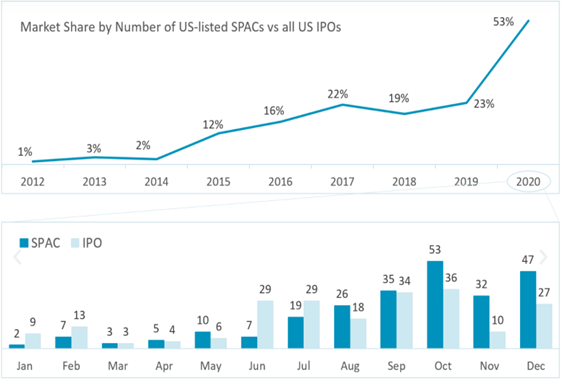

According to SPAC Alpha, the number of SPAC IPOs priced and mergers closed increased ~320% from 2019 to 2020 [Appendix, 1]. The value of SPAC IPOs drastically increased ~512% to $83.4 Billion [Appendix, 1]. Market share by number of US-listed SPACs versus all US IPOs averaged 18.4% from 2015 to 2019 with the highest market share of 23% (2019) [Appendix, 2]. However, in 2020 the market share spiked to 53% [Appendix, 2].

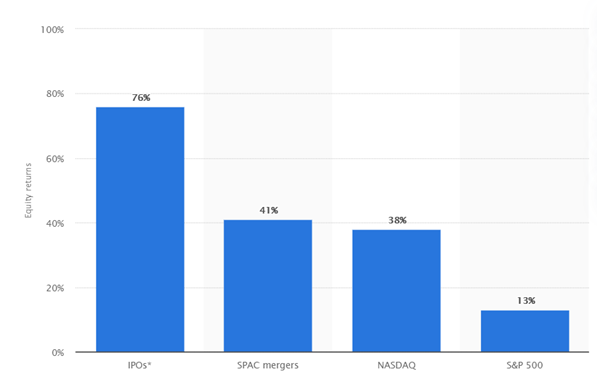

In 2020, the equity returns on SPAC mergers, NASDAQ, and S&P 500 were 41%, 38%, and 13%, respectively[Appendix, 3].

V. Information to Consider

A 2018 study by Goldman Sachs focusing on 56 SPACs that completed acquisitions or mergers found they tend to underperform the S&P 500 during the 3-, 6-, and 12-month period AFTER transaction. A 2017 through mid-2019 study of 108 SPACS in the United States found SPACs had an average of 2% return. However, factors, such as COVID and the “rise of the retail investor”, seem to have affected the financial markets making room for abnormal SPAC returns.

Shareholders must be careful in fully analyzing SPAC disclosures as additional funding is typically needed and the interests of the sponsors might pivot from the interests of the shareholders. Shareholders should:

- Be aware of dilution of shareholder’s interest.

- Must pay attention to prospectus and reports.

Attention must be paid toward the investor base. A possible indicator of higher quality is the combination of who are the sponsors and larger investors. With most things, higher quality managers tend to enter first, and after their deals have been made, lesser quality managers are attracted (SPAC boom).

VI. Conclusion

SPACs offer many advantages including higher valuation, control, and time. If one were to rely on historical analysis, public companies tend to have higher valuation multiples than private. With traditional IPOs, most owners are unable to maintain a significant percentage of their companies. However, the SPAC structure allows owners to maintain a significant percentage. Speed is usually an obstacle for owners considering entrance to the stock market. The nature of traditional IPOs limits their ability to predict when the process will be complete. However, SPACs are required to acquire a company within a two- to three-year span, giving owners clarity on timelines.

One might question, why now? Well, it seems SPACs are being considered a mainstream alternative as well-known investors such as Richard Branson, Tilman Fertita, and Chamath Palihapitaiya have entered the field. Sponsors and owners might observe the increase in retail investor activities as a positive, so they want to capitalize on the increase of cash flow. Finally, in a year marked by volatility, quick entrance to the stock market at a fixed price can be seen as an advantage.

Yes, it may be appealing to enter the SPAC field as it has recently shown a strong return on investment. However, due to the nature of the asset vehicle itself, it is entirely speculative. The investor must place his full trust in the sponsors’ ability to acquire a robust company. Also, before one was to invest, she/he must read the disclosure intensely as sponsors’ and investors’ interests can separate at certain occasions in the acquisition of the target company.

With the recent SPAC performance of nearly 41%, it is worthy to remember here, an average SPAC returned a measly 2% from 2017 to 2019. However, we must remember, these are not ordinary times. The world is under conditions rarely observed before. A pandemic-stricken world has reduced the normalcy of the economy and everyday life while adding more volatility to financial markets.

In our opinion, the surge of stimulus and the rise of the retail investors are most likely the culprits behind the continual demand for highly speculative assets, such as Bitcoin and SPACs. Instead of looking at historical data or educating themselves on a topic, the average investor is flocking to the “hot news,” in this case, SPACs. We believe SPACs will perform well short term, but, contrary to current popular belief, there will be losers in the SPAC market, and one must choose wisely if they wish to enter the SPAC scene.

VII. Additional Sources/Notes

What You Need to Know about SPACs

Special Purpose Acquisition Companies

Conflicts of Interest

Spectacular Rise of SPACs

VIII. Appendix

[1] SPAC Alpha

[2] SPAC Alpha

[3] Statista

To learn more about how Acumen can help you Invest Intentionally®, please contact us.

Charts used in this commentary was obtained via Bloomberg L.P.

The opinions expressed in this commentary should not be considered as fact. All opinions expressed are as of the published date and are subject to change. Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. Investments in securities involves risk, will fluctuate in price, and may result in losses. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation. Comments concerning the past performance are not intended to be forward looking and should not be viewed as an indication of future results. Diversification does not protect against loss of principal.

The S&P 500 Index is widely regarded as the best single gauge of the U.S. equities market. The index includes a representative sample of 500 leading companies in leading industries of the U.S. economy. All indexes are unmanaged and an individual cannot invest directly in an index. Index returns do not include fees or expenses.

Any charts, graphs, and descriptions of investment and market history and performance contained herein are not a representation that such history or performance will continue in the future or that any investment scenario or performance will even be similar to such chart, graph, or description.