Why Are Bond Yields Dropping?

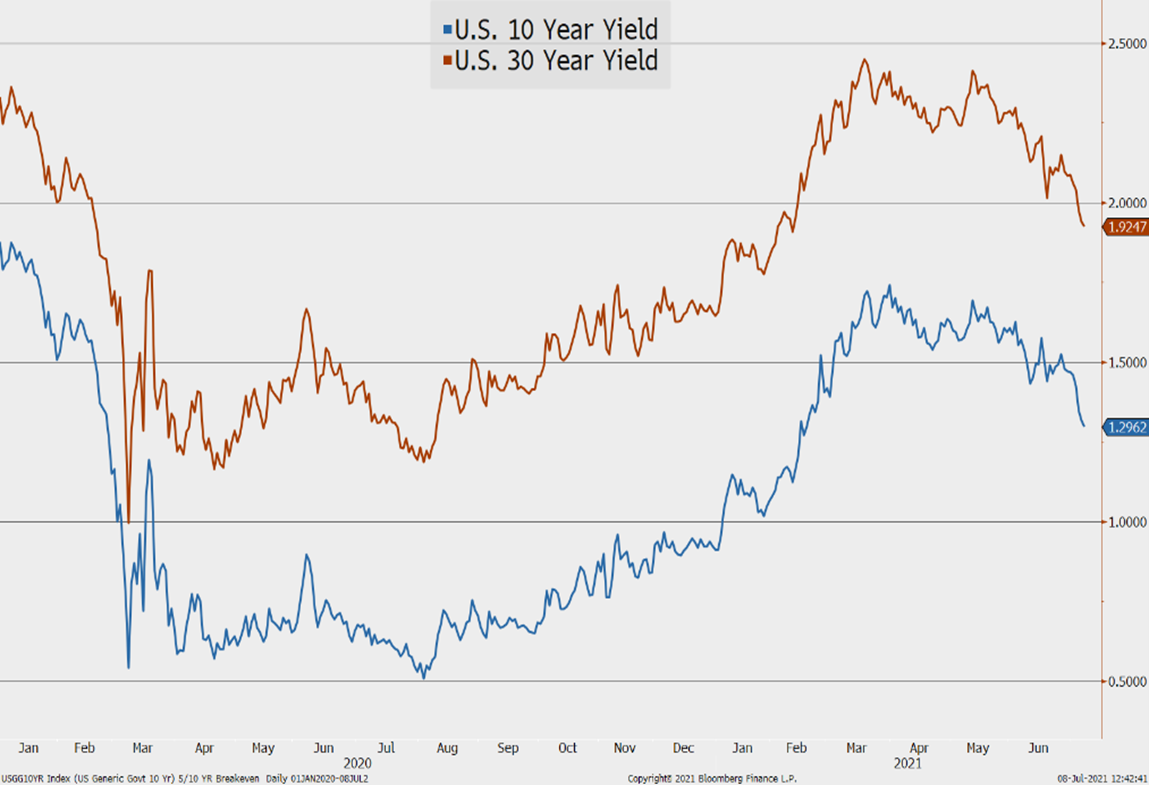

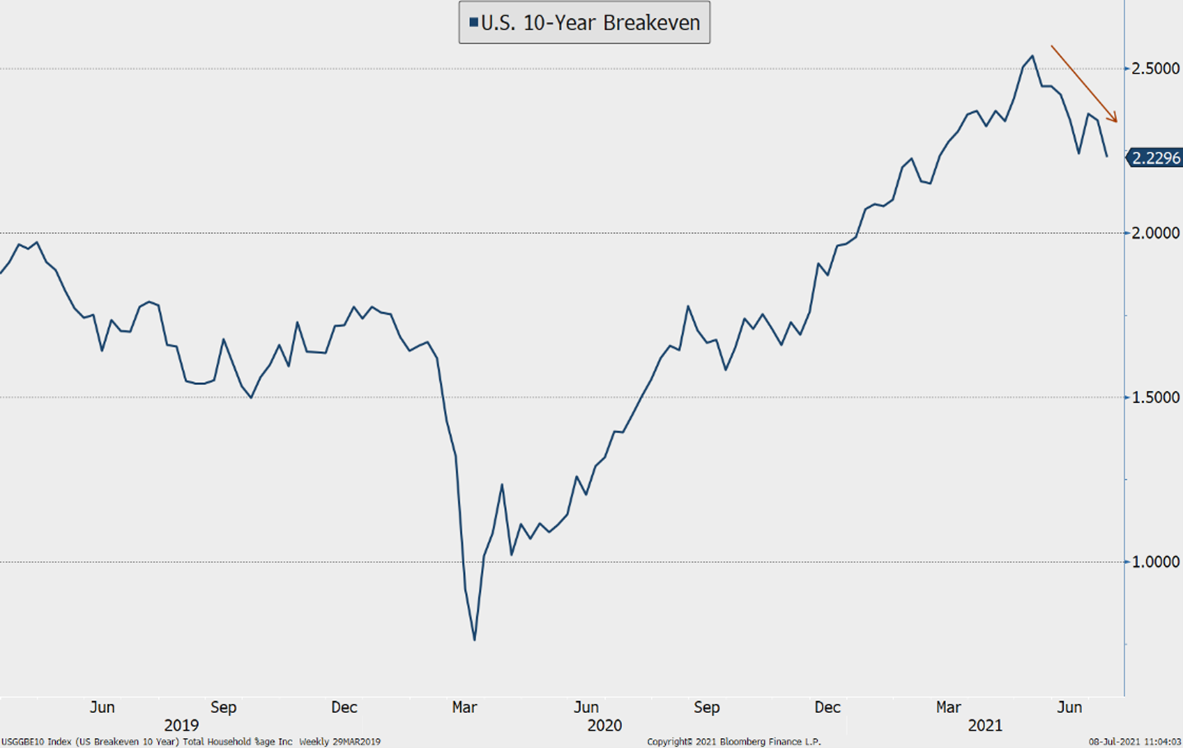

It has been a wild couple of weeks for U.S. Treasury bonds. Because of this situation, we would like to provide an update about what we believe is happening in the bond market. We have been monitoring the cause of the drop in yields since rates started peaking in mid-March. Since then, economic growth and inflation expectations have steadily declined. Bond yields have also fallen.

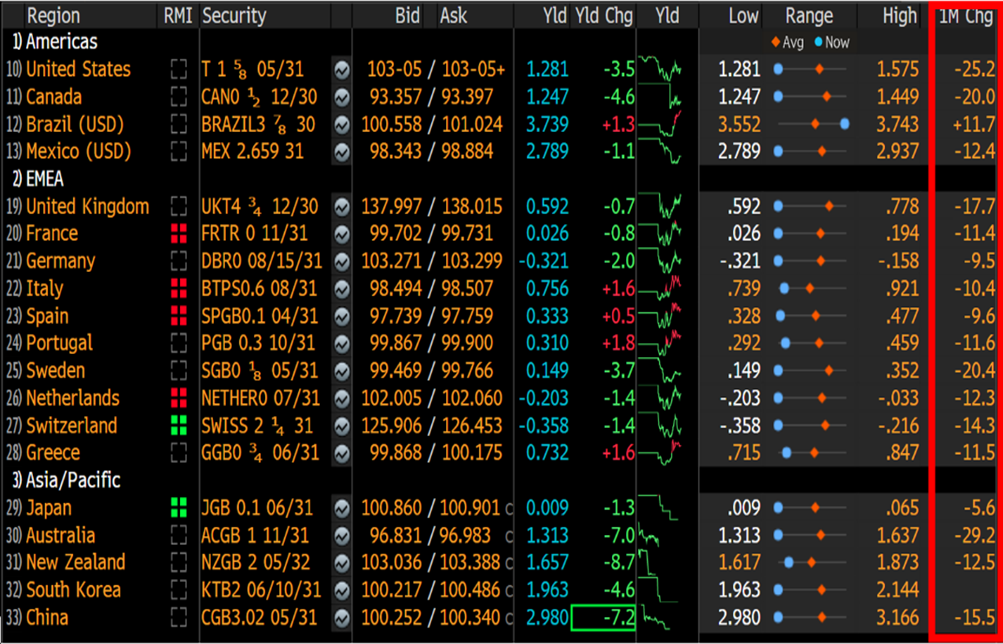

This trend is not isolated to the United States alone. Globally, yields have come down as the reality of temporary inflation, slower job growth, central bank intervention, and eventual slowing economic growth set in. The decline in global yields has likely pushed international investors, looking for higher yields, back into domestic treasuries.

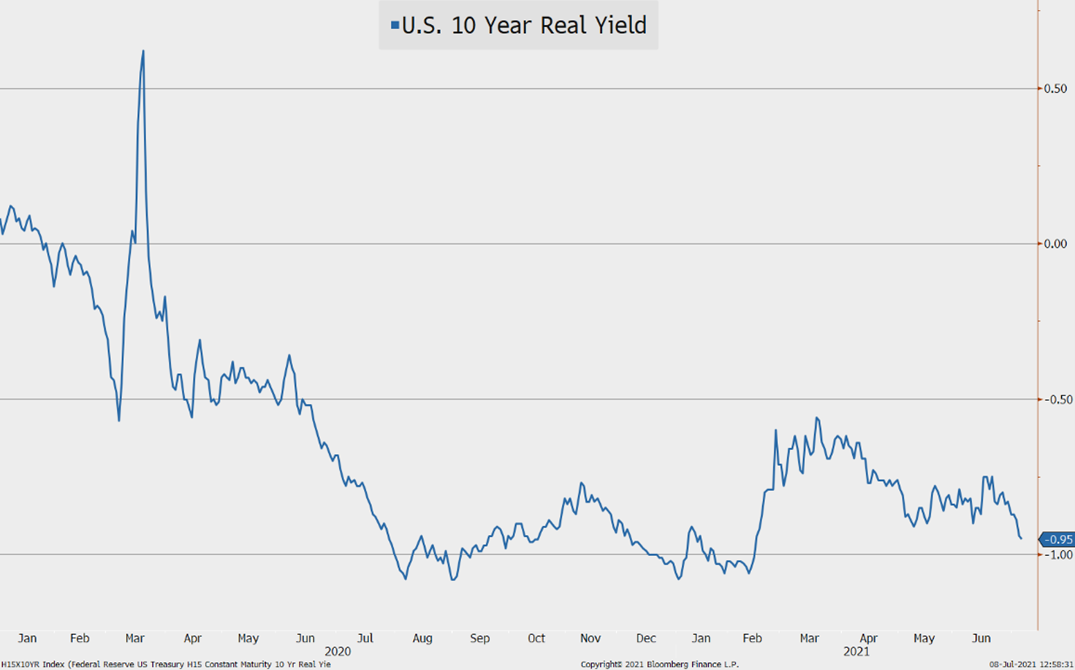

Real yields have dropped to near historical lows. While inflation expectations have come down significantly, yields are dropping faster than inflation expectations.

Even though economic growth is peaking, investors are starting to take a “risk-off” stance. Jim Caron, a portfolio manager at Morgan Stanley, described the current environment as “a peak in growth, a peak in inflation, and a peak in policy stimulus”. As investors digest this and start to accept peaking expectations, it seems they are adjusting their investment holdings accordingly. Investors have started to take a more cautious approach to their equity and fixed income holdings. The shift back into “safer” assets has contributed to the drop in yields. Investors are more willing to accept negative real yields due to the expectation current yields will not seem so low once the economy starts to slow and a hawkish Federal Reserve slows growth even further.

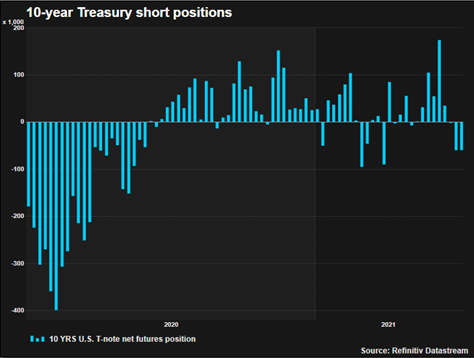

In our opinion, a “risk-off” rotation, global yields dropping, and continued Fed asset purchases are all contributing factors to the drop-in yields. Another force pushing yields lower is a treasury short squeeze. Over the past several months the market has seen net-short treasuries. This trade made sense at the time. It appeared investors believed significant economic growth, hotter than expected inflation, and a more hawkish Fed would push rates higher and bond prices lower. However, inflation does not appear out of control, economic growth is likely peaking, and the Fed is in no rush to implement a policy change. Once yields started dropping, short sellers needed to cover their losses by selling out of their positions, pushing yields even lower. As yields continued to drop, more and more short sellers had to exit their positions continuing the cycle.

While this move in yields might be a surprise to some, we have anticipated this sort of reaction for some time now. It is likely we see yields recover slightly once the short sellers settle and the risk-off rotation slows.

Information and charts used in this commentary were obtained via Bloomberg L.P. as of July 8, 2021.

The opinions expressed in this commentary should not be considered as fact. All opinions expressed are as of the published date and are subject to change. Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. Investments in securities involves risk, will fluctuate in price, and may result in losses. The information has been obtained from sources we believe to be reliable; however, no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation. Comments concerning the past performance are not intended to be forward looking and should not be viewed as an indication of future results. Diversification does not protect against loss of principal.

Any charts, graphs, and descriptions of investment and market history and performance contained herein are not a representation that such history or performance will continue in the future or that any investment scenario or performance will even be similar to such chart, graph, or description.

Acumen Wealth Advisors, LLC® is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Acumen Wealth Advisors, LLC® and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Acumen Wealth Advisors, LLC® unless a client service agreement is in place.