3(21) and 3(38) Fiduciary Services

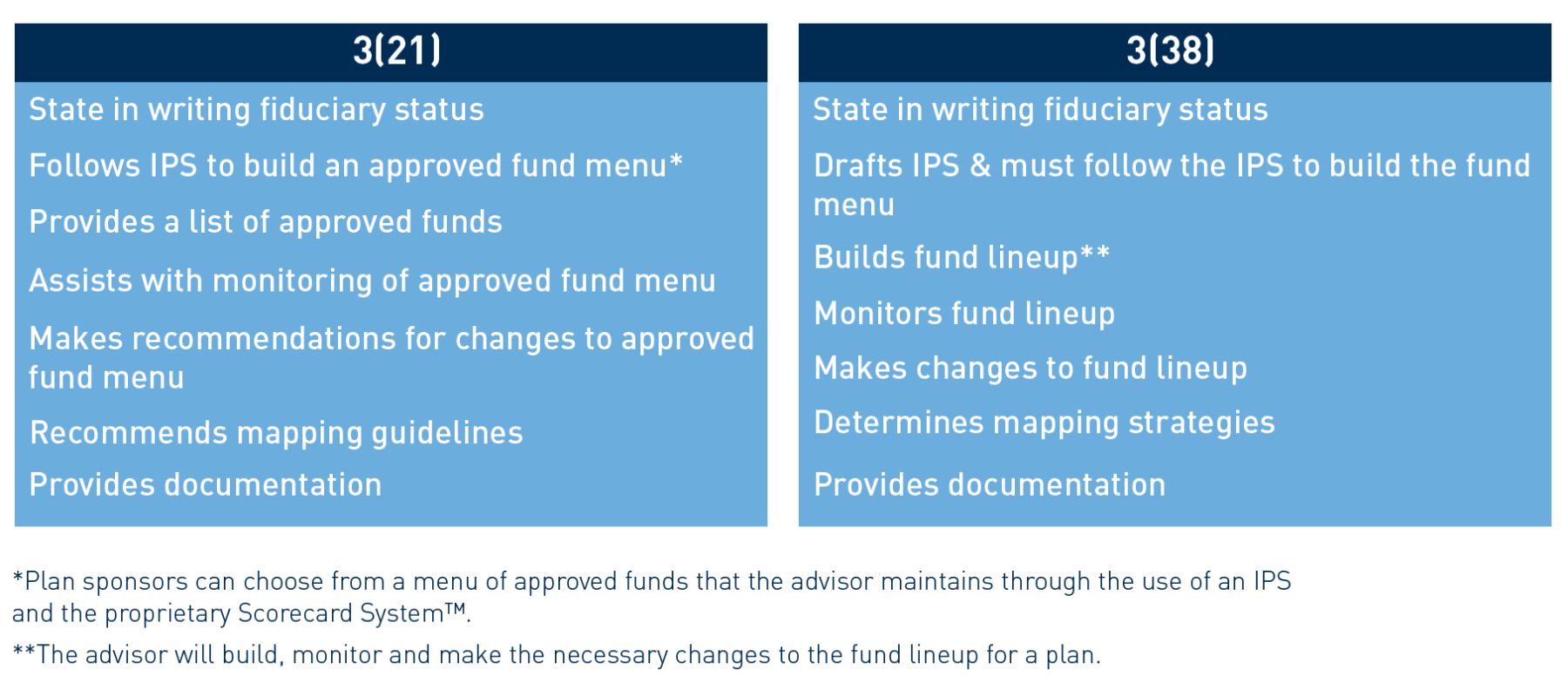

Plan sponsors are required by ERISA to provide an investment lineup for participants that has been prudently selected and monitored to minimize and control risk. To ease this burden, a retirement plan advisor may act as an ERISA 3(21) investment fiduciary with regards to the selection, monitoring and replacement of plan investments or as an ERISA 3(38) fiduciary with full discretion regarding the selection, monitoring and replacement of plan investments.

A retirement plan advisor can serve in either a 3(21) or 3(38) fiduciary capacity, and in some cases, both capacities. The needs and desires of the plan sponsor typically dictate the specific arrangement, which is predicated upon the subject of risk mitigation versus risk avoidance. Some plan sponsors want assistance with their fiduciary responsibilities but want to maintain discretion and control of their plans’ investment menus. Others want to shift responsibilities to a third party due to their lack of expertise, and ultimately, fear of exposure to liability.

Differences

Any individual is a fiduciary under Section 3(21) if he or she exercises any authority or control over the management of the plan or the management or disposition of its assets; if he or she renders investment advice for a fee (or has any authority or responsibility to do so); or if he or she has any discretionary responsibility in the administration of the retirement plan.

Section 3(38) defines “investment manager” as a fiduciary due to their responsibility to manage the plan’s assets. ERISA provides that a plan sponsor can delegate the responsibility (and thus, likely the liability) of selecting, monitoring and replacing investments to a 3(38) investment manager/fiduciary. A 3(38) fiduciary may only be a bank, an insurance company, or a registered investment advisor (RIA) subject to the Investment Advisers Act of 1940.

Similarities

Anyone can call himself or herself a fiduciary, but a fiduciary is determined not only by title, but by actions as well. Both 3(21) and 3(38) advisors accept fiduciary responsibility and adhere to ERISA §404(a)’s duty to serve solely in the interest of plan participants. In addition, both have to meet the “prudent expert” standard of care. Plan sponsors retain the responsibility to select and monitor the advisor, regardless of their advisor’s fiduciary status. Plan sponsors should consider the advisor’s experience, skill and level of expertise, in addition to their desire to take on exposure to potential liability.

The Scorecard System

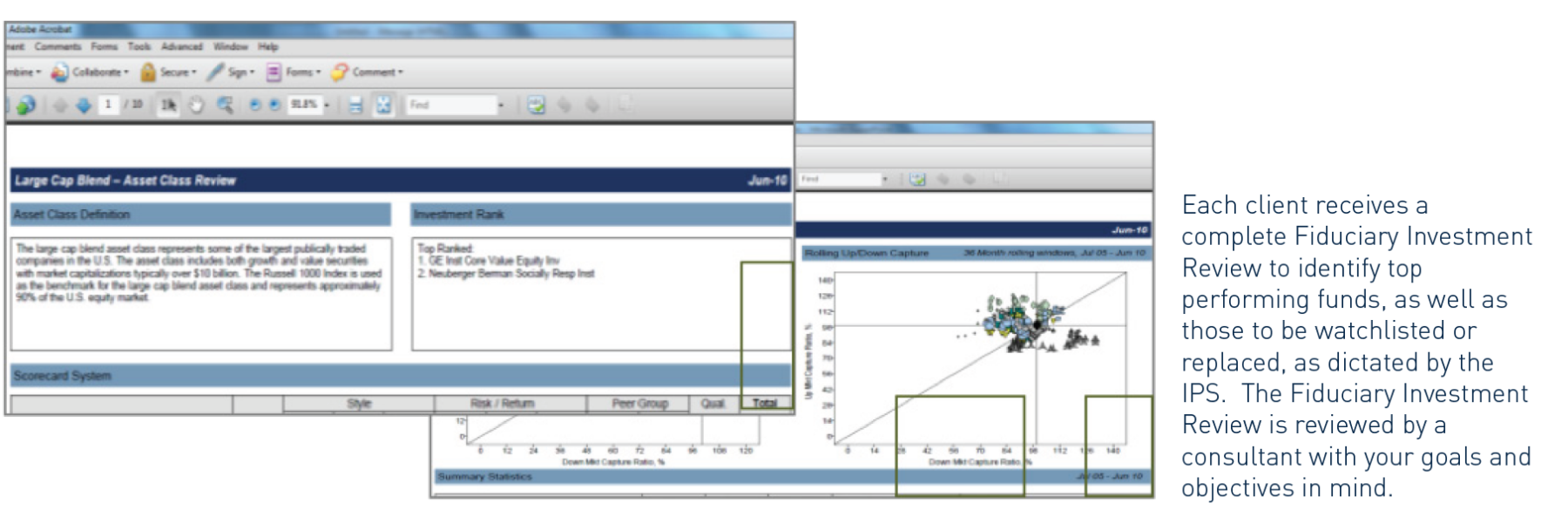

Retirement Plan Advisory Group’s proprietary Scorecard System™ is an independent industry pace-setter that takes into account risk adjusted return characteristics, as well as style, peer group rankings and qualitative factors. This institutional approach, which can be used for plans of any size, utilizes a straight forward 0 to 10 pass/fail criteria to evaluate funds and fund managers.

Eighty percent of the fund’s score is quantitative, incorporating modern portfolio theory statistics, quadratic optimization analysis, and peer group rankings. The other 20 percent of the score is qualitative, taking into account factors such as manager tenure and the fund expenses. The System evaluates active, passive and asset allocation strategies.

Working with a retirement plan advisor as your 3(21) or 3(38) fiduciary has great potential to limit your exposure to fiduciary liability, while reducing the time and expertise required to perform the plan’s ongoing investment monitoring and selection duties. Most of the responsibility for (and virtually all responsibility in the case of 3(38) engagement) investment-related decisions is shifted to the advisor, giving the plan sponsor greater peace of mind and time to focus on other aspects of its business.

Acumen Wealth Advisors, LLC® is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Acumen Wealth Advisors, LLC® and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Acumen Wealth Advisors, LLC® unless a client service agreement is in place. Acumen Wealth Advisors, LLC® is affiliated with RPAG and utilizes their robust retirement plan consulting tools and resources to deliver enhanced value to plan sponsor clients. RPAGTM, a wholly owned subsidiary of NFP (NFP Corp.), provides retirement advisors premier technology, systems, training, and resources through its practice management platforms.

The information contained herein has been prepared solely for informational purposes and is not an offer to buy or sell or a solicitation of an offer to buy or sell any security or to participate in any trading strategy. Any decision to invest according to investment advice provided by Acumen Wealth Advisors, LLC® should be made after conducting such investigations as the investor deems necessary and consulting the investor’s own investment, legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of an investment. Acumen Wealth Advisors, LLC® and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters contained herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone unaffiliated with Acumen Wealth Advisors, LLC® of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties. This document was produced by and the opinions expressed are those of Acumen Wealth Advisors, LLC® as of the date of writing and are subject to change. This research is based on Acumen Wealth Advisors, LLC® proprietary research and analysis of global markets and investing. The information and/or analysis contained in this material have been compiled or arrived at from sources believed to be reliable, however Acumen Wealth Advisors, LLC® does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. Any sectors or allocations referenced may or may not be represented in portfolios of clients of Acumen Wealth Advisors, LLC®. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. The use of tools cannot guarantee performance. Past performance is no guarantee of future results. ACR#241146 05/17