Acumen’s Commentary on Drop in Oil

04/21/20

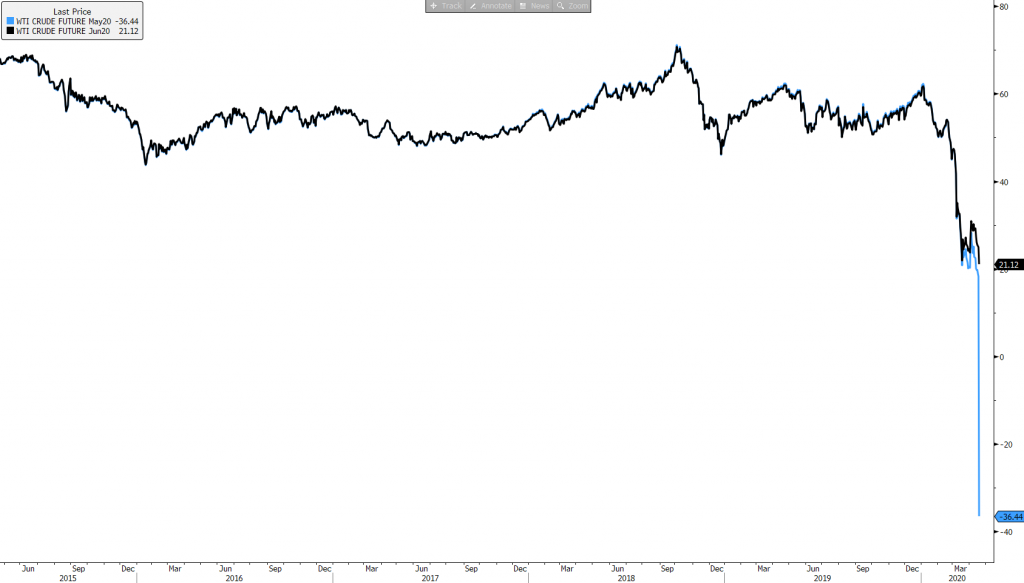

Out of everything we have seen in the financial markets thus far in 2020, the jaw-dropping collapse in the price of Crude Oil contracts set to expire on Tuesday might be the most jarring. The price of West Texas Crude fell into negative territory – minus $37.63 a barrel – meaning sellers were paying buyers to take the contracts off their hands. The reason for the collapse is most likely due to the complete absence of room to store the physical barrels by which the contracts trade on. Nobody wants to take delivery of the actual contract because there is nowhere to store the physical oil. Typically, the holders of oil futures contracts will either sell the contract and roll over the position to the next month’s expiration, giving someone else the physical delivery of the asset. Today, the price of contracts for May 20th delivery completely collapsed as there was absolutely zero demand to cover the contracts rolled off to the next month. This can be displayed by the difference in the May 20th expiration contracts and the June 20th expiration contracts. This was more than likely an anomaly, as the event was something traders likely had never input into their risk models, and we will likely never see something of this effect again. There are implications though. We now have a better grasp on just how little demand there is for the delivery of physical oil – as the global economy has pretty much come to a standstill while there has been a lack of decrease in output. As for investors wishing to make substantial allocations to the distressed asset, we don’t fully know the medium-term effects of what is happening in the oil market since this is unlike anything we have ever experienced. While the price of next month’s contract is not likely to plummet as we have seen this time, without substantial pickup in demand for the commodity, its volatility could be tumultuous. We don’t believe in attempting to catch a falling knife. Until we have a better understanding of the fundamental implications of the physical oil market disruption, we remain pessimistic on the commodity. Until then, the most attractive investment in the space seem to be energy companies with high-quality balance sheets, such as the ones currently held in Acumen-managed client portfolios. These investments will likely gain from the eventual recovery in the oil market with now more limited downside.

Chart provided by Bloomberg L.P. as of April 20, 2020.

To learn more about how Acumen can help you Invest Intentionally®, please contact us.

Grant Allen, Portfolio Analyst

About the Author: Grant Allen is a Portfolio Analyst for Acumen Wealth Advisors in Chattanooga, TN. Grant holds a Bachelor of Science in Finance-Investments from the University of Tennessee at Chattanooga’s Gary Rollin’s College of Business and has successfully passed Level One for the Chartered Financial Analyst® (CFA®) designation. The CFA® consists of three levels of exams, each requiring a recommended 300+ hours of study, minimum of four years of work experience, and multiple letters of recommendation. Exams cover Quantitative Methods, Economics, Financial Reporting and Analysis, Portfolio Management, Wealth Planning, and Ethics.

The opinions expressed in this commentary should not be considered as fact. All opinions expressed are as of the published date and are subject to change. Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. Investments in securities involves risk, will fluctuate in price, and may result in losses. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation. Comments concerning the past performance are not intended to be forward looking and should not be viewed as an indication of future results. Diversification does not protect against loss of principal.

Any charts, graphs, and descriptions of investment and market history and performance contained herein are not a representation that such history or performance will continue in the future or that any investment scenario or performance will even be similar to such chart, graph, or description.

Acumen Wealth Advisors, LLC® is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Acumen Wealth Advisors, LLC® and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Acumen Wealth Advisors, LLC® unless a client service agreement is in place.