Acumen’s Q2 2020 Market Commentary

07/02/2020

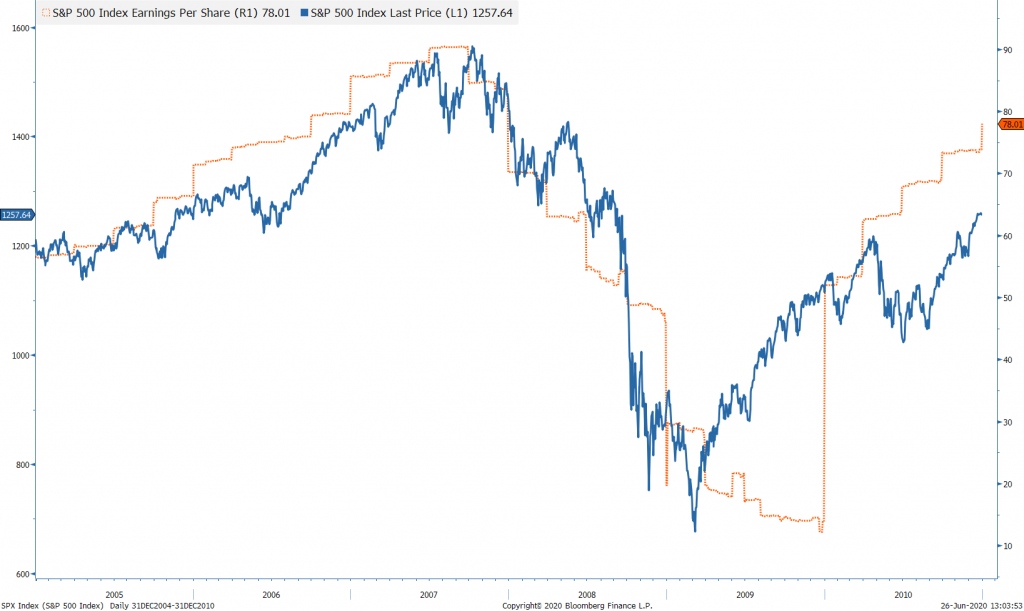

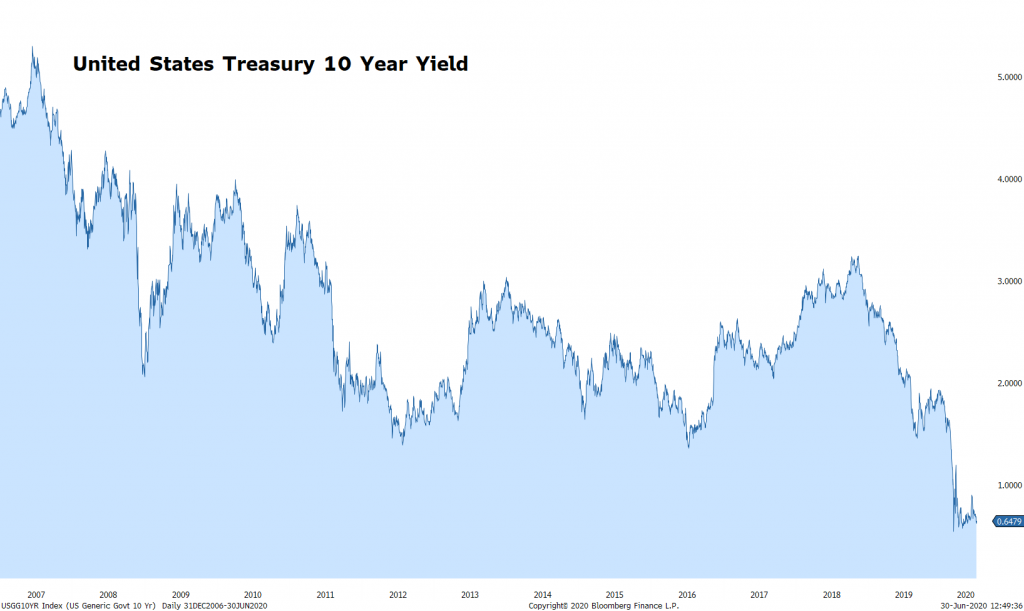

What We Saw in Q2

The second quarter of 2020 showed no signs of deceleration in delivering wildcard narratives. When we wrote to clients at the end of the first quarter, we alluded to the confusion many investors experienced after witnessing the fastest equity market drawdown ever, accompanied by a complete economic shutdown, and then followed by a 15% stock market melt up in the final two weeks of the quarter. The three months following the Q1 commentary carried a financial market where risk assets experienced a large recovery and better economic data that seemed to support it. Much was “up in the air” regarding which way the shifting landscape of COVID-19 would lead us, and investors faced the daunting task of sticking to their investment strategy during a time where it felt so unnatural to do so. The market was kind to those who did, as equities began their sharp rally on March 23rd and have, until recently, showed no signs of slowing down. Many investors questioned the rally in risk assets throughout the quarter, and rightly so. The lift should be somewhat attributed to the changing narrative regarding the spread of COVID-19. Throughout the second quarter, we gained a better understanding on how to deal with the virus itself, how it spreads from person to person, and when a treatment should be expected. We also saw a dramatic change in the number of people who were contracting the virus from day to day. During the same time, the Federal Reserve generated a plan to place a massive backstop on financial markets to insure liquidity, while the current administration injected the economy with even further liquidity in the form of the Payments Protection Program and a $1,200 stimulus check to millions of Americans. The market is forward looking in its nature and investors were faced with the decision to deploy cash into a credit market producing close to 0% yields for the next few years or into riskier assets facing near-term disruption in the global economy but a somewhat certain resumption of normalcy at some date within the next 18 months. It is incredibly important to understand the futuristic viewpoint of financial markets; it better equips investors to stick to their long-term strategy. From the graph below, we can see this futurism through the lens of the Great Financial Crisis, as the S&P 500 Index bottomed months before company earnings found any sort of recovery.

The Second Half and Beyond

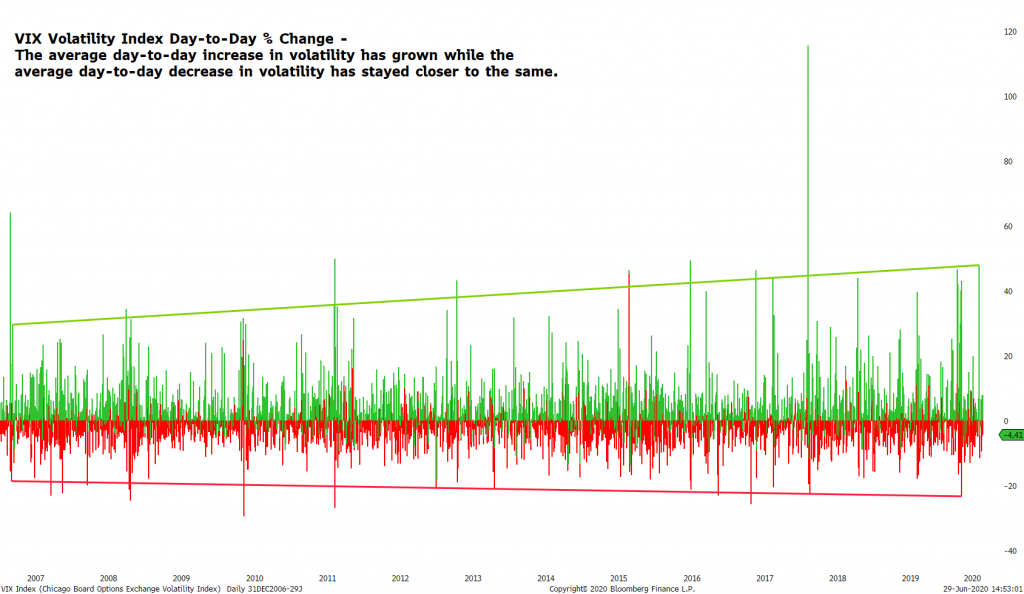

While we do not practice making absolute assumptions about which way the market is heading in the near term, the second- and third-order effects of what is experienced can have lasting implications on portfolios. One of the most important expectations for the remainder of 2020 would be the continuation of heightened market volatility. Investors probably experienced one of the most uncomfortable markets ever as the CBOE Volatility Index (VIX) increased more than 500% in the matter of a month from February 14, 2020 to March 16, 2020. While such a drastic increase in such a short amount of time is abnormal, we believe investors should continue to expect uncertainty to continue in the short term. For the long term, realized volatility should be greater than the historical average. A presidential election, the absence of a COVID-19 vaccine, social unrest, and a further-stepping central bank will all contribute to greater speculation of asset prices and continued turbulence. A close historical study of the velocity of short-term price changes has shown volatility has steadily increased on a day-to-day perspective over the last 20 years. That, combined with a deeper interconnectedness, gives us confidence portfolios will need to be better diversified and more intentionally exposed.

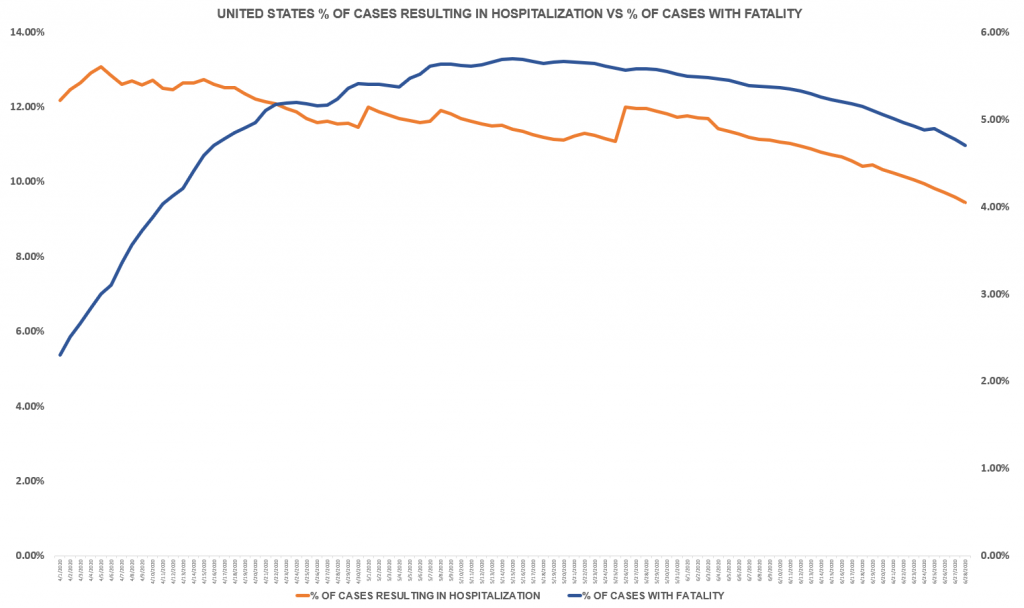

Obviously, a primary narrative, continuing to add uncertainty to financial markets, is the outbreak of the Coronavirus. From the onset of the COVID-19 pandemic, we have steered clear from assuming the role of epidemiologist and have instead, focused on consistently monitoring and mapping the data. Since so little was known about the virus, markets largely were reactionary to the spread itself – how many people would be infected and could we slow it down. Throughout the global shutdown, as we learned more about the virus, the market became increasingly more dependent on more detailed information regarding the virus rather than infection rates. We believe the market and investors will further focus on the severity of cases themselves, rather than just “how many more people will get the virus.” This focus shift is confirmed by states, such as Florida, seeing a record number of cases from day-to-day while also seeing the market continue to show optimism over risk assets. While more and more people are being infected by the virus since we began reopening the global economy, fewer and fewer people are dying and hospitalized because of the infection.

Our Thoughts and What We are Doing About It

We have continued to form a dynamic opinion about how the events in 2020 have affected the global economy as well as our overall response to them. The events and the responses to them will drive asset prices and investor behavior in the future. While we do not attempt to predict what will happen, we strive to better understand the probabilities of what could happen and position client portfolios accordingly. Additional risk is being injected into financial markets in the form of COVID-19 pressures. We have no intentions on formulating an opinion on what WILL happen. Instead, we have increasingly focused on what IS happening. The data we have been monitoring has shown an increase in the number of people who are contracting the virus, but a decrease in the severity of the cases themselves. This information leads us to believe the threat of another widespread economic shutdown is not near, but we will continue to monitor. The fiscal and monetary policy response to the COVID crisis has also caused us to shift our investment thesis slightly. First, the added liquidity to the economy and cash in peoples’ pockets, causes us to believe the intermediate term effects will be a quicker rebound in economic activity. Second, we see the threat of an increase in inflation pressures in the medium to long term as a result from the increased money supply and a possible breakdown in the U.S. dollar. We have used a gold allocation across portfolios to compliment this thesis and serve as a possible hedge to uncertainty. Lastly, the collapse in fixed income yields has caused us to formulate the following ideas:

- Upward pressure will be placed on risk assets over the next 18 months because of the lack of income generation available through fixed income assets.

- Fixed income exposure should be increasingly used as a diversification tool through assets having little, no, or even negative correlation to risk assets whose prices are being sent higher through increased risk-taking.

- Investors will need to be further detail oriented and focused on their investment exposure to take advantage of themes that will be furthered by new regimes like the increased use of technology from day-to-day. We prefer to add exposure to riskier assets through more focused exposures. Instead of investing in a broad style or industry, we believe investors will need to be more focused on the niche areas. Instead of a broad technology exposure, we are more optimistic about technology investments focused on disruptive technologies, like cloud computing, and less focused on the high-flying Large Cap technology stocks which are now priced at elevated levels. We believe this ideology will be further pushed in the future.

To learn more about how Acumen can help you Invest Intentionally®, please contact us.

Information used in this commentary was obtained via Bloomberg L.P.

The opinions expressed in this commentary should not be considered as fact. All opinions expressed are as of the published date and are subject to change. Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. Investments in securities involves risk, will fluctuate in price, and may result in losses. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation. Comments concerning the past performance are not intended to be forward looking and should not be viewed as an indication of future results. Diversification does not protect against loss of principal.

Any charts, graphs, and descriptions of investment and market history and performance contained herein are not a representation that such history or performance will continue in the future or that any investment scenario or performance will even be similar to such chart, graph, or description.

The S&P 500 Index is widely regarded as the best single gauge of the U.S. equities market. The index includes a representative sample of 500 leading companies in leading industries of the U.S. economy. The S&P 500 Index focuses on the large-cap segment of the market; however, since it includes a significant portion of the total value of the market, it also represents the market. Created by the Chicago Broad Options Exchange (CBOE), the Volatility Index, or VIX, is a real-time market index that represents the market’s expectation of 30-day forward-looking volatility. Derived from the price inputs of the S&P 500 index options, it provides a measure of market risk and investors’ sentiments.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.