Acumen’s Q4 2019 Market Commentary

A 2019 Retrospective

2019 was the year of the persistent futurist. Investors ignored much of the volatility injected into the market resulting from trade–themed tweets and an economic grey zone. The market reflected a slowing manufacturing sector and decelerated business investment, but a resilient consumer. Two primary top-down themes, Global Trade and Global Monetary Policy, shaped the market’s atmosphere during 2019 all while a slowing economic growth developed.

Trade

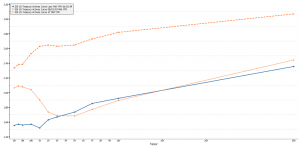

Putting all biases aside to the validity of the path the US and China have taken in the trade war, an objective observation of the effects of the trade war is important to forecast future growth. Forecasts have recently been altered, since a “Phase 1” deal was announced on December 13th. This deal allows our firm to believe our previously held notion of “these two administrations both have so much to gain from finding common ground, they have to at least attempt to work together” is valid. Investors had the same presumption. Global economic weakness appeared in 2019 which was clearly seen through manufacturing weakness and lower business investment. Chart 2 explains. One of the leading economic indicators used is the Purchasing Managers’ Index (PMI). This reading gives a broader view of forecasted demand for goods and services, specifically on the manufacturing side. The PMI is typically an indicator of future economic headwinds. There was a large divergence in the high correlation of measurements with the S&P 500. The S&P returned +31.5% for 2019 and was largely a result of a strong consumer. The consumer seemingly propped up the global economy as it attempted to work out the kinks thrown in by trade tensions and slowing growth. The small upwards trend in PMI, seen at the chart’s head, might indicate the consumer remained optimistic long enough to provide a soft landing. Retail sales and other signs of consumer confidence during the beginning of 2020 will validate this stance or bring reason to adjust strategy.

Monetary Policy

The forward-looking nature of the equity market was another factor contributing to 2019’s growing both domestic and abroad. The forecasted economic recovery of a Eurozone on the brink of a recession and a United States finding its footing in this new slow growth environment was all built on the back of dovish central banks. At home, the Federal Reserve ended a period of policy rate increases and pivoted to rate reductions in what was called an “insurance policy” for an economy facing slowing global growth. Abroad, we began to see negative interest rates – which is still somewhat of a mystery to many investors. Lower (and negative) rates were a key driver to the 2019 environment. Eventually, these negative rates are reflected in fixed income yields, which drove up fixed income prices and supported lofty equity returns. During the middle of the year, domestic long-term rates had gotten so low from a combination of low inflation and foreign investors hunting for yield, the Federal Reserve lowered its key policy rate. The lowered rate brought the short end of the yield curve back down, mitigating inversion. Inversion has preceded every recession since the 1980’s and is typically looked at as a red flag. However, the Federal Reserve luckily contained enough gun powder in the form of higher short-term rates, they were able to re-steepen the curve, bringing short-term interest rates back down relative to long-term rates. To equity investors, this shift served as a tailwind. Easier monetary policy is typically an indicator of greater business investment and more borrowing stimulated the economy. To fixed income investors, the yield hunt was on. To economies, stimulated growth was a result of easier money.

Acumen’s Outlook for 2020

2020 will undoubtably follow a different narrative than 2019. While 2019 was the year of multiple expansion on the back of the consumer, the geopolitical optimist, and the yield hunter, Acumen believes 2020 will follow a much more typical story of slower and steadier growth with marginally increasing profitability as a result of a more attractive macroeconomic backdrop. While we do not believe the length of an expansion or a bull market makes a clear case for a reversion, we do believe in managing expectations from a fundamental view. Essentially, most of the equity assets seems fairly priced when considering forecasts. This observation can be seen from chart 4 displaying the S&P’s price trading right at 19.5x which is its forward 12 months earnings, i.e., how much you will pay per $1 of earnings. This multiple is closely approaching 1 standard deviation above its average, a signal we believe represents a fair price. Unless growth forecasts are revised upward, it will be hard for domestic equities to breach far past the multiple it’s now trading. Note, although this forecast does not mean domestic equities will not find price appreciation during 2020, we believe the contrary. This means investors shouldn’t expect the +25% growth found during 2019. Out of domestic equities, investors should instead expect high single-digit growth, barring an uptick in geopolitical risk. We believe 2020 success will be found through opportunity, managing risk and expectations, and remaining unbiased and objective when interpreting information.

Acumen sees some opportunities. Investors will not receive the return from fixed income found in 2019 with forecasted “lower for longer” rates. Since there is not much more room for a decrease in rates, fixed income investors will need to find returns elsewhere. For this reason, Acumen favors equities paying higher dividends – a space we already prefer for investors. However, we find higher paying equities more favorable during 2020 when considering low rates for fixed income vehicles and the quality of most of these investments proving favorable during the later stages of the economic cycle. We also prefer the outlook for international equities and emerging markets more than we did in 2019. Easing trade tensions, a bottoming of international economies, and a weaker outlook for the U.S. dollar all point to a better year for these assets. Fundamentally, these assets are also trading at their greatest discount relative to domestics than they have in quite some time. Since the recession, we can observe from chart 4, the S&P has increased its price spread over the International Index and the Emerging Markets Index to its highest level in 20 years. This increase has come on the back of a strong dollar, an accommodative Federal Reserve, and a weak economic environment abroad. We believe there will be a slight shift in this narrative during 2020 and we are tactically adjusting portfolios accordingly by bringing equities to their target allocation within each objective.

Closing Remarks

History should tell investors fear of stocks being doomed for a correction following such a long expansion and such strong gains during 2019 may be overstated. Since 1929, the S&P 500 has posted a greater-than-20% gain in only 23 of the years in the 90-year period. The following year, stocks returned positive 16 times and the average return of these years outpaced the long-term annual return. Since 1980, the S&P was up an average of 12.1% the year after 20% gains. This leads us to believe that the length of this bull market or economic expansion is not a reason for its speculated end.

Speculating when economies and markets will turn and pivot from one inflection to the next is an exercise in futility and a first-class time waster. Markets are efficient since everyone has the same information. Prices reflect this information within milliseconds. Unless one has insider knowledge, you can be assured if you know something, so does somebody else. We are no longer playing the information game. Everyone has the information; it just comes down to who can be the most objective when interpreting it.

Throughout history, the one proven recipe for long-term investing success has never changed during market struggles. It has been, and for now will remain, to stay committed to an objective process, remaining even-keeled throughout, and to be opportunistic when we believe the idiosyncratic factors will dominate the fundamental story.

Acumen’s Portfolio Management Team is committed to refining this strategic process because it is something we believe in, and ultimately, want to offer the best road to long-term capital preservation for those who trust in us.

To learn more about how Acumen can help you Invest Intentionally, please contact us.

Happy New Year!

Grant Allen, Portfolio Analyst

About the Author: Grant Allen is a Portfolio Analyst for Acumen Wealth Advisors in Chattanooga, TN. Grant holds a Bachelor of Science in Finance-Investments from the University of Tennessee at Chattanooga’s Gary Rollin’s College of Business and has successfully passed Level One for the Chartered Financial Analyst® (CFA®) designation. The CFA® consists of three levels of exams, each requiring a recommended 300+ hours of study, minimum of four years of work experience, and multiple letters of recommendation. Exams cover Quantitative Methods, Economics, Financial Reporting and Analysis, Portfolio Management, Wealth Planning, and Ethics.

Information used in this commentary was obtained via Bloomberg L.P.

Any charts, graphs, and descriptions of investment and market history and performance contained herein are not a representation that such history or performance will continue in the future or that any investment scenario or performance will even be similar to such chart, graph, or description.

The opinions expressed in this commentary should not be considered as fact. Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation. Comments concerning the past performance are not intended to be forward looking and should not be viewed as an indication of future results. Diversification does not protect against loss of principal.

The S&P 500 Index is widely regarded as the best single gauge of the U.S. equities market. The index includes a representative sample of 500 leading companies in leading industries of the U.S. economy. The S&P 500 Index focuses on the large-cap segment of the market; however, since it includes a significant portion of the total value of the market, it also represents the market. The Russell 2000 Index® measures the performance of the 2,000 smallest companies in the Russell 3000 Index. The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The Bloomberg Barclays Intermediate US Government/Credit Bond Index is a broad-based flagship benchmark that measures the non-securitized component of the US Aggregate Index with less than 10 years to maturity. The Purchasing Managers Index (PMI) is a measure of the prevailing direction of economic trends in manufacturing. The PMI is based on a monthly survey of supply chain managers across 19 industries, covering both upstream and downstream activity. Price to forward earnings is a measure of the price-to-earnings ratio (P/E) using forecasted earnings. All indexes are unmanaged and an individual cannot invest directly in an index. Index returns do not include fees or expenses.

Acumen Wealth Advisors, LLC® is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Acumen Wealth Advisors, LLC® and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Acumen Wealth Advisors, LLC® unless a client service agreement is in place.