Financial Planning: Roth Conversions

Leveraging financial planning strategies is a key benefit of working with Acumen Wealth Advisors. As laws change, we work with clients to take advantage of new opportunities. Roth conversions are one financial planning strategy Acumen is implementing for clients.

There are two primary retirement accounts used by most individuals:

Traditional IRA/ 401(k)

- Tax-deferred account where the contribution is deductible when funding the account, the account grows tax deferred, but the value is taxed upon withdrawal.

- Individuals accumulate significant balances through contributions while working.

- Individuals are required to begin taking distributions based on their required beginning date, currently 73 for those born after 1951, but increases to age 75 in 2033.

Roth IRA

- Account holder pays the taxes “up front” when a contribution is made, the account grows tax free, and there is no tax on distribution.*

- No required distributions for the account holder.

- Widely utilized and recommended for individuals who anticipate their income or tax liability will be higher in the future.

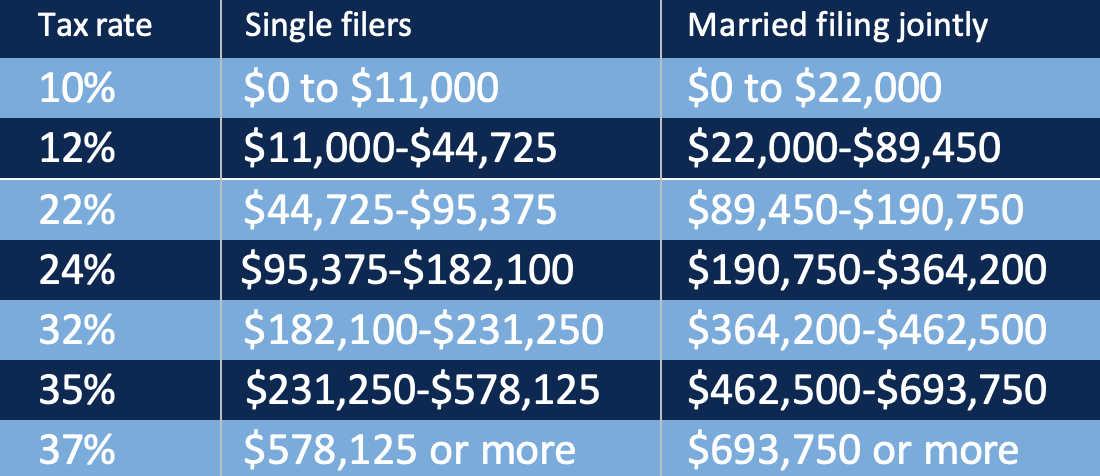

In addition to a much higher standard deduction, the ranges for several tax rates have increased and the percentage has also decreased. The tax rates and corresponding income brackets for 2023 are:

- For individuals with large IRA account balances, the distribution amount can be substantial enough to push them into a higher tax bracket.

- This income sensitivity is particularly concerning when other sources of earned income, such as pension, social security, or substantial interest income, are included.

Roth Conversion

- The strategy consists of taking a portion (or all) of a traditional, tax-deferred IRA account balance and converting it into a tax-free Roth IRA.

Acumen’s financial planners work with clients to assess the IRA funds necessary to be converted on an annual basis to effectively reduce future tax liability while staying in the lowest current tax bracket possible. The Tax Cuts and Jobs Act of 2017 reduced the individual tax rates and effectively doubled the standard deduction, but these provisions are only temporary and will expire in 2026.

- Acumen believes this time frame is a window of opportunity for optimal Roth conversion implementation.

- Although Roth conversions will create a tax liability for the converted amount, Acumen believes it may be better to pay the taxes in today’s relatively low tax rate environment and then enjoy tax-free growth and withdrawals from a Roth IRA without having to worry about future tax rates.

- We believe at this point, when it comes to taxes, “The devil you know is better than the devil you don’t.”

The effect of the 2017 tax cut can be seen with the annual federal deficit growing 60.31% from September of 2017 to September of 2019. Future tax rates are unknown, but it is widely anticipated the government will have to take some spending reduction and/or revenue increasing action to combat this deficit – actions such as increasing tax rates.

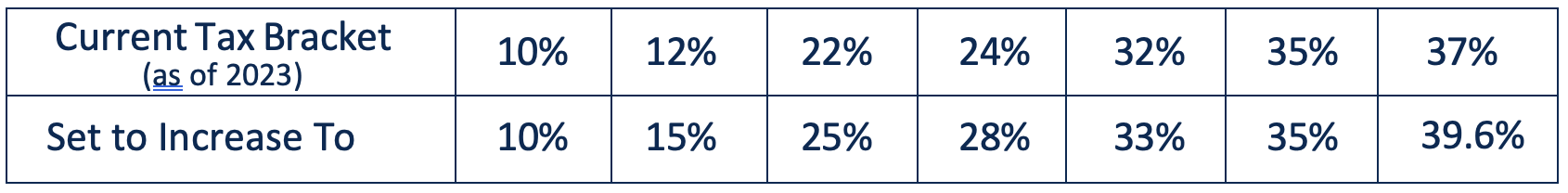

As it stands, the tax rates are set to increase in 2026 when the current tax law sunsets. Additionally, the applicable ranges will be lowered, and the standard deduction will effectively be halved.

Roth Conversion Benefits for IRA Beneficiaries

- When the owner of a traditional IRA account passes, the account is inherited by the beneficiary(ies) listed on the account. This beneficiary could be a surviving spouse who will become a single tax filer and, consequently, have a lower income threshold for higher tax rates.

- The RMDs from an inherited IRA can also affect children who, in many cases, find themselves in their prime income earning years. This situation can present a problem as the owner of the inherited IRA must start taking RMDs which adds to their existing income and presents the possibility of being pushed into a higher tax bracket.

- This issue was not as unfavorable before the passage of The Secure Act since the inherited IRA owner could use their life expectancy for RMD calculations, a provision, referred to as a “Stretch IRA”, resulting in a lower annual withdrawal amount.

- The Secure Act has eliminated the “Stretch IRA” provision and now the entire account balance must be taken within ten years.

Inherited Roth IRA Benefits

- The owner of an Inherited Roth IRA is required to take RMDs, but the withdrawals are tax free and do not count towards income.

- The benefit of inheriting a Roth IRA, as opposed to a traditional IRA, is attractive for individuals who wish to leave a tax-efficient legacy.

We encourage you to reach out to our team to help you plan and protect your legacy.

* Withdrawals are not taxable as long as the account has been opened five years or the account owner is over age 59½. First home purchase and college expense exceptions also apply.

Information as of 06/28/2023