Fixed Income Commentary

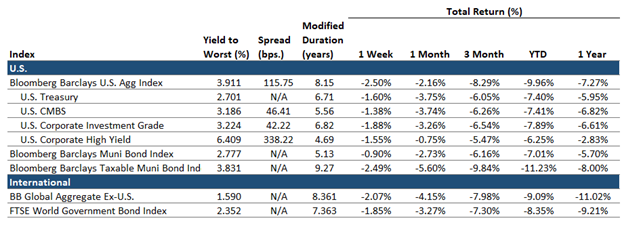

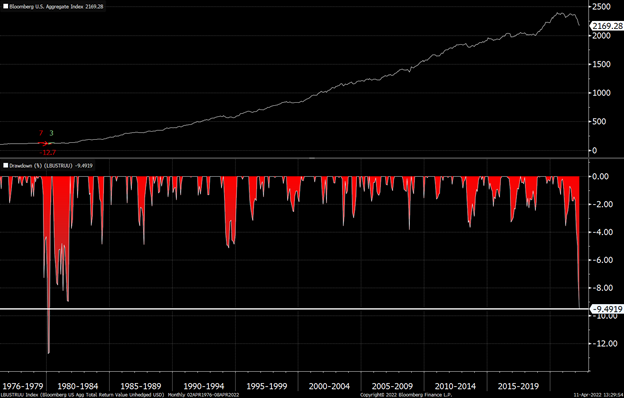

The bond market is experiencing one of the worst drawdowns in recent history. Figure 2 below illustrates the magnitude of the drawdown and helps put the severity into perspective. We have not seen price decreases like this since the bond bear market of the late 1970’s and the financial crisis of 2008. A hawkish Federal Reserve, looking to abate decade high inflation, has been the catalyst for pushing yields higher.

Over a typical market cycle, bond yields will fluctuate depending on expectations of economic growth and inflation. As yields move up, fixed income prices come down. Since the late 80’s, bond yields have trended lower with a few short-term exceptions. This long-term trend of lower yields has allowed bonds to perform extremely well over the past 40 years. When yields move sharply higher, like in today’s market, prices move down. Like mentioned earlier, the first quarter of 2022 has been one of the worst quarters for fixed income returns in recent history because bond yields have risen so much.

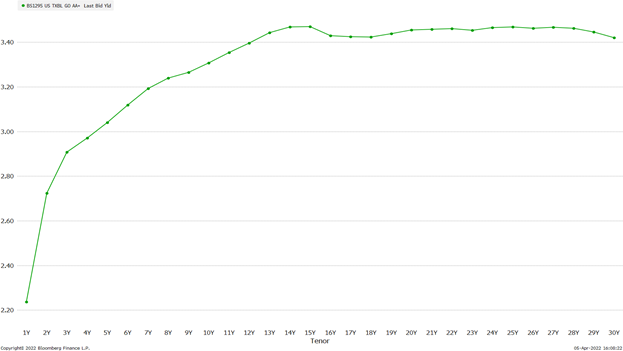

In our core fixed income allocation, we currently prefer high quality municipal bonds. We look for value within this investment universe, and when possible, purchase individual bonds instead of using a bond ETF or mutual fund. We believe purchasing individual bonds, in the long run, provides opportunity for higher income and lower expense cost for our clients. Buying individual bonds allows us to lock in yields when we find value. When an investor holds a bond, they receive that bond’s coupon payment each year. No matter how much the price of the bond moves, the coupon payment stays the same. As the bond moves toward maturity, the price will converge to par. Bonds with longer maturity are more price sensitive than those with shorter maturity dates. While the price is more sensitive, longer maturity bonds have the advantage of locking in higher yields for longer periods of time.

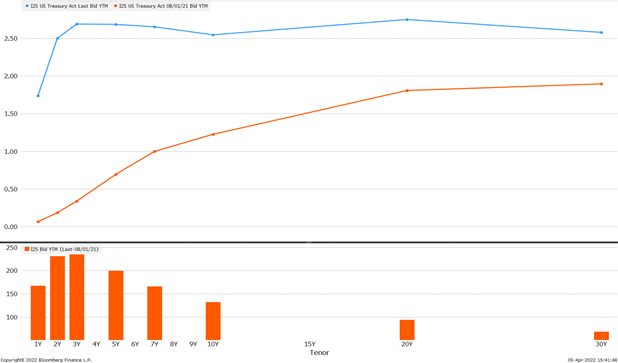

Last year, until December, short term yields were extremely low, and the yield curve was steep (see orange line in chart below). Investors were rewarded for buying longer maturities. At that time, our inflation expectations were in line with the Federal Reserve’s. We believed any inflation we would experience would be transitory and, even if inflation were to stick around, we expected long-term inflation expectations to remain anchored. With the steepness of the curve, and the belief long-term inflation expectations were anchored, we saw an opportunity to pick up higher yields at longer maturities. As the reality of more persistent inflation presented itself, we slowed bond purchases in expectations of higher yields across the curve.

Headwinds in the bond market are still present; central bank policy changes, tighter financial conditions, geopolitical issues, and higher inflation could all present more trouble for the bond market. This bond market repricing has been difficult to digest, but opportunities for higher income are finally presenting themselves. Current yields, when compared to recent history, seem reasonably priced and the risk/return appears to be favorable for the first time in many years. Below is the current taxable AA Muni yield curve.

Over the long term we still believe yields will continue their downward trend, but in the short term we expect to see yields continue to drift higher. As long as supply chains remain broken and the Russia/Ukraine conflict continues to put upward pressure on food and energy costs, we should expect inflation to remain present. The longer inflation sticks around, the higher yields will rise. In the short term, the volatility in the bond market can be tough to handle. Fortunately, our investments in bonds are long term in nature and yields we lock in today we still expect to be higher than yields we might see in 4 to 5 years.

Major Takeaway:

Inflation has proven to be more persistent that most economists had originally anticipated. To counter this, the Fed is aggressively implementing restrictive policy. The combination of higher inflation and restrictive monetary policy has brought bond yields, especially short-term bond yields higher. The recent surge in yields has contributed to one of the worst bond drawdowns in the past 40 years. We do not believe the recent increase in yields is the beginning of a long-term trend, but rather an opportunity to lock in higher yields.

Information used in this commentary was obtained via Bloomberg L.P.

The opinions expressed in this commentary should not be considered as fact. All opinions expressed are as of the published date and are subject to change. Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. Investments in securities involves risk, will fluctuate in price, and may result in losses. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation. Comments concerning the past performance are not intended to be forward looking and should not be viewed as an indication of future results. Diversification does not protect against loss of principal.