Our Analysis of GameStop

For years, GameStop has struggled to adapt to the changing landscape of video gaming. It was founded in 1996 when the Nintendo 64 and first-ever PlayStation were exploding in popularity. Online retail was just getting started. Amazon and eBay had just launched their E-commerce sites the year prior when GameStop began offering gamers a place to buy, sell, and trade new and used consoles, and videogames. But, as the internet progressed, GameStop stuck to its brick-and-mortar strategy and failed to establish its online presence. Now, gamers can preorder consoles online and have them delivered to their door. And when they want to sell a used game, they can sell it themselves online.

This situation had led many Wall Street hedge fund managers to short sell (bet against) the company. Simply put, a short seller borrows shares from someone who owns them, sells them on the open market, and agrees to repurchase them to return to the owner later. The short seller hopes the price declines so, when he/she buys back the stock from the market, it will be at a lower price than what they initially sold it. If the short seller repurchases it at a lower price, he/she pockets the difference between their sell and buy prices after returning the shares. If the price increases, the short seller must repurchase at a higher price and lose money.

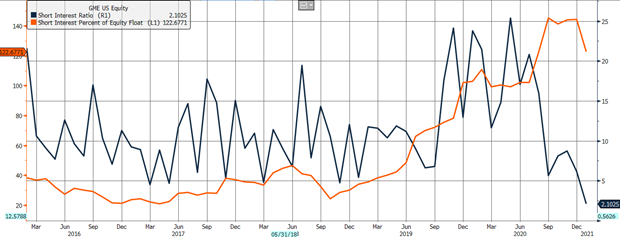

The chart above shows GameStop’s short ratio in blue which compares the number of shares that have been sold short and the average daily trading volume. The orange line shows the percentage of shares that have been sold short versus all the shares available to be traded. Over time, the bets against GameStop got bigger, and some thought the bets were too big.

Enter Ryan Cohen, the co-founder of the online pet supplies store, Chewy. Cohen’s venture capital firm acquired a 10% stake in GameStop in 2020, and he joined the company’s board of directors in January with hopes he could help transform the brand into a modern online retailer. This acquisition was big news to retail investors who believed in Cohen and his vision for the company. They began sharing their thoughts about a potential turnaround on social platforms, specifically on the Reddit group, WallStreetBets, which now has over eight million members.

But, instead of investing in a turnaround, WallStreetBets began planning something else; members had noticed the massive short-selling of GameStop stock and thought they could coordinate an attack on the hedge funds by forcing a short squeeze. In other words, if the smaller retail investors could band together and purchase GameStop shares, share prices would rise, and the hedge funds, who had shorted the company would be forced to buy their borrowed shares back at a higher price. As the larger hedge funds began buying back shares to close their short positions and limit their losses, the influx of demand sent GameStop shares soaring from $20 to nearly $350 in just two weeks. At the same time, more and more retail investors joined brokerage apps, like Robinhood, to help the cause and to cash in at the expense of the hedge funds. WallStreetBets and internet traders began to target other companies hedge funds had bet against, and companies, such as AMC Entertainment, BlackBerry, and Nokia, were the next on the list. Those companies would see their trading volumes more than double in the last week of January.

Sure, the hedge funds were the first to lose money, and they lost plenty. In just a matter of days, firms lost billions of dollars in the GameStop trading frenzy. But, over time, more retail investors were drawn in by $0 trading fees on easy-to-use brokerage apps and the opportunity to realize huge gains in just a few days. As hedge funds were closing their positions, retail investors kept piling money into GameStop shares either in protest against the Wall Street elite or to gamble the old-fashioned videogame retailer’s shares would keep climbing forever. Ironically, some hedge funds have made millions with new short positions since they knew price correction was inevitable, all at the expense of individual investors.

Demand for GameStop shares was detached from company fundamentals and quickly progressed to market mania. Charles Kindleberger describes how these situations play out in his book “Manias, Panics, and Crashes.” Typical of manias, some event changes the outlook, investors chase after some investment opportunities to the point of excess, and then once the excess is realized, investors rush to spare their returns and reverse the expansion. This panic causes investors to switch from real or financial assets (like GameStop stock) to cash and liquid assets resulting in the crash of the related asset prices. As of this writing, GameStop shares are trading at around $40, an 88% decline from the high reached at the end of January.

The trading frenzy is scarily similar to the outlawed “bucket shops” of the late 1800s when customers wagered on stock price movements. But, like the low-cost ETFs and free brokerage apps of today, bucket shops also opened financial markets to a new wave of participants. Robinhood and others have removed the barriers for smaller investors by eliminating account minimums and trading fees. The rise of retail investing and its effect on the broader market is a phenomenon some have dubbed the “Robinhood Effect,” and its full implications may take time to understand. While the events of recent weeks have been a case study on the matter, they have only affected a select few companies and have left everything else unaffected. Volatility indicators of major equity indices have remained near their historical levels so far this year. Investors with a well-diversified portfolio, backed by a thorough research process, can significantly reduce their risk to periods of mania and panic. We believe awareness of these excesses allows us to conduct better research and make better decisions for our clients. The bottom line is you can in all likelihood ignore the GameStop news if you keep a long-term investment horizon and focus on fundamentals.

To learn more about how Acumen can help you Invest Intentionally®, please contact us.

Notes

- Two Small-Time Investors Were Buying GameStop Stock Before It Was Cool

- The Real Force Driving the GameStop Revolutionhttps://www.wsj.com/articles/the-real-force-driving-the-gamestop-amc-blackberry-revolution-11611965586

- “Where the Common People Could Speculate”: The Ticker, Bucket Shops, and the Origins of Popular Participation in Financial Markets, 1880–1920 https://doi-org.proxy.lib.utc.edu/10.2307/4486233

- “Manias, Panics, and Crashes: A History of Financial Crises” Robert Z. Aliber; Charles P. Kindleberger

Chart information used in this commentary was obtained via Bloomberg L.P. as of 12/31/2020.

The opinions expressed in this commentary should not be considered as fact. All opinions expressed are as of the published date and are subject to change. Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. Investments in securities involves risk, will fluctuate in price, and may result in losses. The information has been obtained from sources we believe to be reliable; however, no guarantee is made or implied with respect to its accuracy, timeliness, or completeness.

Any charts, graphs, and descriptions of investment and market history and performance contained herein are not a representation that such history or performance will continue in the future or that any investment scenario or performance will even be similar to such chart, graph, or description.