Q1 2023 Market Commentary

2022 Summary

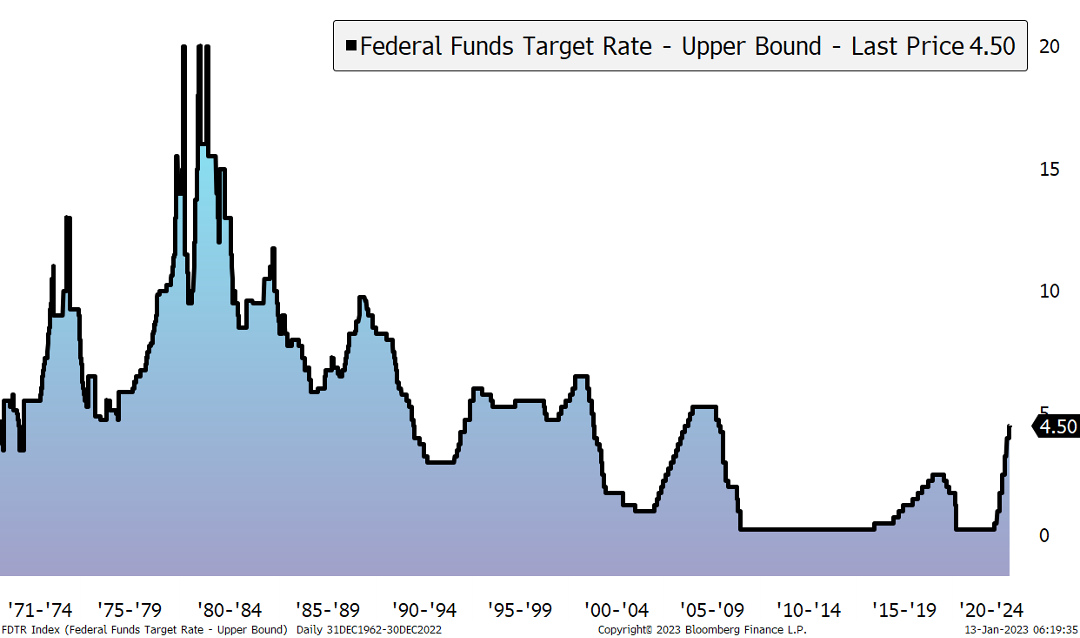

Last year was characterized by double digit price declines across major asset classes. The S&P 500 declined 18.13%; the Aggregate Bond index declined more than 13%; and the traditional 60/40 portfolio was down more than 16% for the year. Areas more sensitive to changes in interest rates were hit the hardest. Growth stocks underperfomed value and speculative assets (such as Bitcoin and the Ark Innovation ETF) both declined more than 60%. The primary cause of this market action was central banks raising benchmark rates in an attempt to cool inflation. The U.S. Federal Reserve raised their benchmark rate from 0.00%-0.25% to 4.25%-4.50% during 2022. This rate is the fastest change in their benchmark rate in percentage terms in that short of a time horizon. During the year, inflation continued to surprise to the upside, forcing central banks to raise rates further which led to continued volatility in financial assets.

Macro Landscape

Inflation

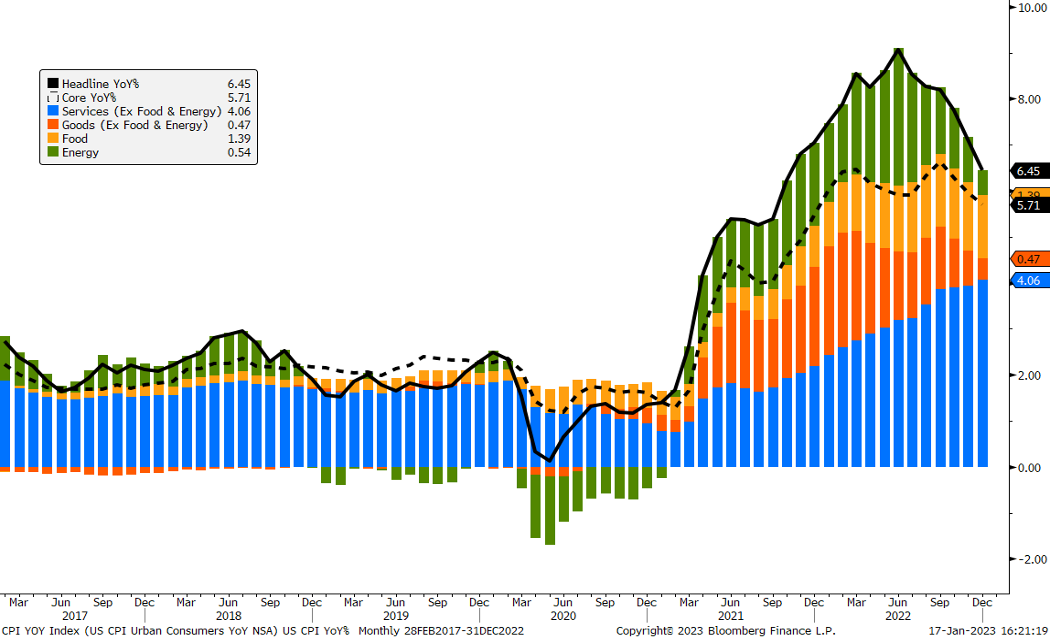

Headline inflation data has cooled since mid-2022, but remains well above the Fed’s target of 2%. Volatile food and energy prices seem to have peaked, inflation for goods has cooled sigificantly as supply chains have improved, but services inflation has remained stubbornly high. The primary force behind high services inflation is shelter costs which makes up around 40% of core Consumer Price Index (CPI). But, it is important to note rent prices, as measured by CPI, lag actual home prices. More real time data (such as Zillow/Apartment List rent indexes) lead the rent component of CPI by around 6 to12 months. These indexes have shown Month/Month declines in rent prices since September. The overall housing market has also slowed down significantly. Therefore, the shelter component of CPI should likely peak at some point in the first half of 2023, and then help overall readings of inflation further decline.

Labor Market

A historically strong labor market allowed the Fed to maintain a hawkish stance throughout 2022. Labor market indicators, such as the unemployment rate, are pointing towards an extremely tight labor market. We would argue similar indicators are backward looking, and typically, the labor market is the last thing in the ecomony to turn in response to changes in interest rates. The labor market is starting to show some cracks beneath the surface. At first glance the December Payrolls/Household jobs report showed data that seemed to support the idea of a still-tight labor market. Below the surface, there is some weakness. The household report showed 700,000 jobs were added in December, but this was driven by the addition of part-time workers. Also, there were roughly 400,000 more people with multiple jobs. Furthermore the number of individuals working temporary jobs typically declines ahead of the rest of the labor market, and this number declined for the third month in a row in December. Finally, nearly all added jobs came from those with a high school degree and not a college degree. All of these factors indicate to us the labor market is cooling, and the economy is weakening.

Economic Conditions

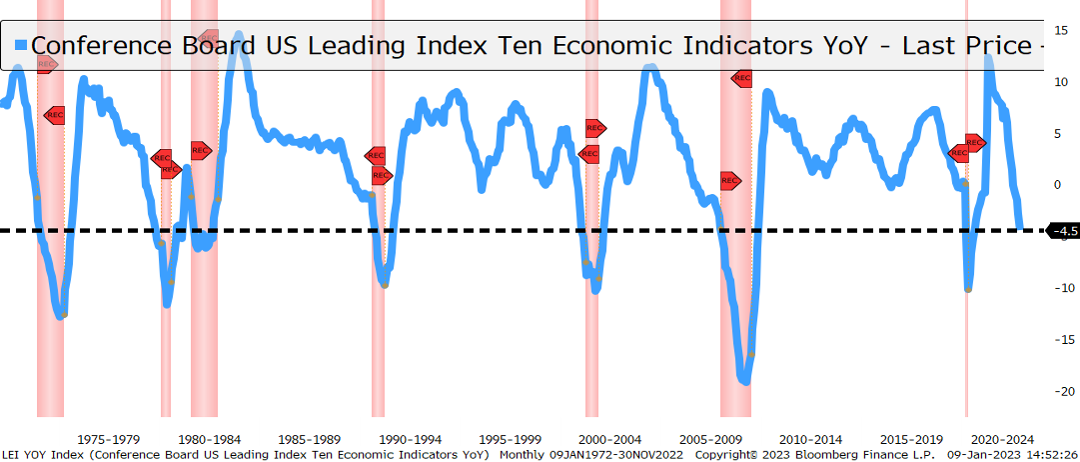

Many leading indicators point to a slowdown in economic growth and a change in the business cycle in the next-12 months. Nearly the entire treasury yield curve is inverted, and the 3-month/10-year yield spread is the most inverted since the 1980s. Historically, when this spread inverts, there has almost always been a recession within the next 18 months. Additionally, the Index of Leading Economic Indicators peaked in the middle of 2022 which points to a recession at some point in 2023. Both the Institute for Supply Management (ISM) Manufacturing Purchasing Managers’ Index (PMI) and the Services PMI have fallen below 50 which indicates slowing growth in both the goods and services parts of the economy. All this together leads us to believe the U.S. economy will move from the slowdown phase of the business cycle to the contraction phase in 2023.

Monetary Policy

The Fed indicated in December they would raise their benchmark rate further in 2023 and end the year at 5.1%. Market expectations are the Fed will raise their benchmark rate to nearly 5% in mid 2023, but end the year at 4.4%. In other words, the market expects the Fed to be forced to cut rates in the middle of this year due to weak ecomomic data. As we have already discussed, we believe the economy is already showing early signs of weakness and we expect this to continue further. Therefore, we agree more with the market’s expectations the Fed will be forced to cut interest rates this year in light of a contracting economy. It is also worth noting the Fed did not adjust their policy quick enough in response to early signs inflation was heating up, and we also expect there is a risk they will not respond quickly enough to early signs inflation is now cooling. If the Fed maintains higher rates for longer, even while the economy slows and inflation cools, it would likely cause a sharper economic contraction at some point.

Portfolio Implications

During 2022, we were mainly focused on reducing risk in client portfolios. We believed the change in monetary policy, coupled with slowing economic growth, would provide headwinds for equities. We utilized positions such as short-term U.S. treasuries as a place to invest while the volatility played out and the yields in those investments were as high as they were in the early 2000s. Today, we believe the primary theme for this year will be utilizing those short term positions to search for opportunity. As our outlook for the Macro Landscape details, we believe the global economy will move from a slow down to a contraction. Contrary to what many investors do throughout time, this period usually provides the greatest opportunity for investment. Some areas of the equity market are beginning to look attractive over the long term. Additionally, this environment typically sees bond yields fall. For this reason we believe there is opportunity to invest in longer maturity fixed income, locking in higher yields, and providing downside protection in case of a greater contraction than we predict.

Information used in this commentary was obtained via Bloomberg L.P.

Any charts, graphs, and descriptions of investment and market history and performance contained herein are not a representation that such history or performance will continue in the future or that any investment scenario or performance will even be similar to such chart, graph, or description.

The opinions expressed in this commentary should not be considered as fact. All opinions expressed are as of the published date and are subject to change. Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. Investments in securities involves risk, will fluctuate in price, and may result in losses. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation. Comments concerning the past performance are not intended to be forward looking and should not be viewed as an indication of future results. Diversification does not protect against loss of principal.

Acumen Wealth Advisors, LLC® is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Acumen Wealth Advisors, LLC® and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Acumen Wealth Advisors, LLC® unless a client service agreement is in place.