Q1 2024 Commentary

Since the beginning of the pandemic three years ago, markets have weighed the potential effects of massive shifts in economic growth, monetary policy, and geopolitical tensions. Both the optimists and the pessimists have had evidence to support their expectations for the economy; Acumen’s role is to find opportunity in the volatility of this push and pull which always exists in markets. In the short term, our outlook will vary. In the long term, we remain optimistic about the economy and your investment portfolio. At Acumen, we remain committed to positioning your portfolio to weather short-term volatility while continuing to be allocated with adherence to long-term goals. We appreciate your trust.

Below, we provide a brief review of markets last year, what we anticipate, and how your portfolio has performed.

Moving into 2023, most major banks and even Federal Reserve staff were predicting a recession in the U.S. Rates had risen, leading economic indicators had worsened, there was trouble in the banking sector, and worsening geopolitical conflicts all supported the generally pessimistic view of the economy. However, markets began revising the outlook as the labor market remained strong, consumer spending grew, and artificial intelligence (AI) gave hopes of higher productivity. The pessimistic expectations were met with a better-than-expected reality; consequently, equity markets boasted double digit returns in 2023. However, the macro-economic landscape is still complex, and risks to economic growth remain as the Fed looks to finish its fight against inflation.

From where we are positioned today, risks remain, and we believe portfolios should be diversified against these risks. However, we find the macro picture much more mixed, offering reasons for both pessimism and optimism.

“Optimism is essential. Pessimism is a self-fulfilling prophecy.”

Nassim Nicholas Taleb

A pessimist might focus on:

- Monetary policy remains restrictive with the current Federal funds target rate exceeding the current rate of inflation (referred to as the real Fed funds rate),

- Geopolitical tensions persist with continued conflict between Russia and Ukraine, revised tensions in the Middle East which could call for a larger response, and potential for conflict between China and Taiwan,

- Leading economic indicators, such as a largely inverted Treasury yield curve and 17 months of decline in the Conference Board’s Leading Economic Index, suggest a contraction in the business cycle, and

- There is evidence of some loosening in the labor market from the recent ultra-tight level. (There has been an average of 1.5 job openings per unemployed person in the U.S. throughout 2023.)

There are many reasons to be optimistic about the macroeconomic outlook as well, such as:

- The labor market remains incredibly tight and the number of people filing for unemployment has remained stable, contrary to expectations,

- Easing supply chain pressures have helped inflation readings trend lower without too much damage to the labor market,

- Global central banks are expected to make a concerted pivot to more accommodative monetary policy with market participants pricing in around six rate cuts from the Fed at some point in 2024,

- A large amount of cash is on the sidelines and asset bases have risen with higher home prices and stock markets near/at all-time highs, and

- Large positive impacts are possible from the adoption of Artificial Intelligence which have yet to be factored into earnings and margin expectations.

In a period where the macro-outlook is mixed, we believe it is essential for investors to take a diversified approach, and to not overweight a specific macroeconomic outcome. Against such a complex backdrop, we find investors will need to take an opportunistic approach which encourages directing capital towards investment themes having attractive growth and diversification benefits. We outline a few areas where we have the highest conviction starting 2024.

- The Resumption of Normal Interest Rates

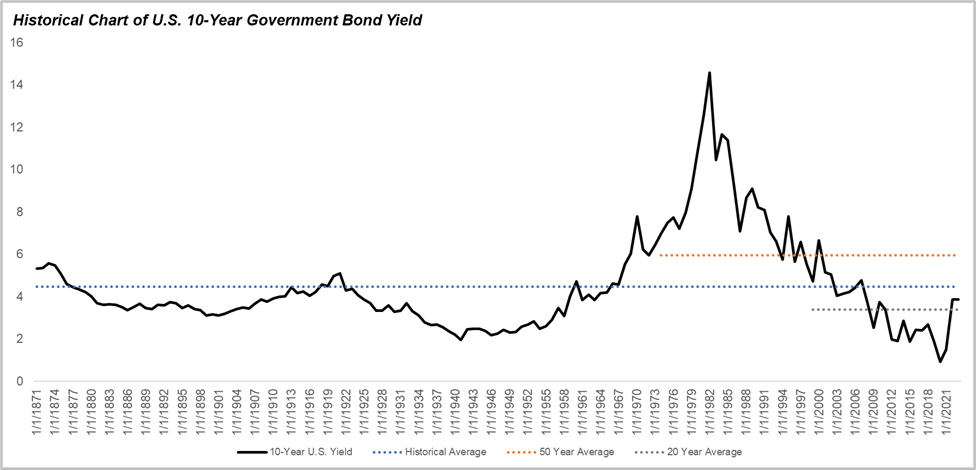

Given the downward trend in interest rates from 2007 to 2020, a large adjustment was needed in financial markets when the Fed, alongside other global central banks, began their most aggressive restrictive monetary policy campaign since the late 1970s. This adjustment was felt across both stock and bond markets with headline indices in both asset classes displaying double digit losses in 2022. 2023 was a volatile year for rates, but the 10-year yield on U.S. government debt started and ended the year at the same place. While rates are now higher than they have been over the previous decade, investors should be looking at current levels as normal instead of exceptionally high. Over the long term, we are encouraged by this “more normal” level for rates.

Low interest rates create excessive risk taking. Excessive risk taking can lead to bubbles and boom-bust-cycles in financial assets, too much leverage, and imprudent investments from companies and investors(1). A few of these events have played out in the years after the Global Financial Crisis (GFC) as the Fed held short-term rates near zero, and some countries had negative short-term rates.

2. Renewed Optimism for the Balanced Portfolio

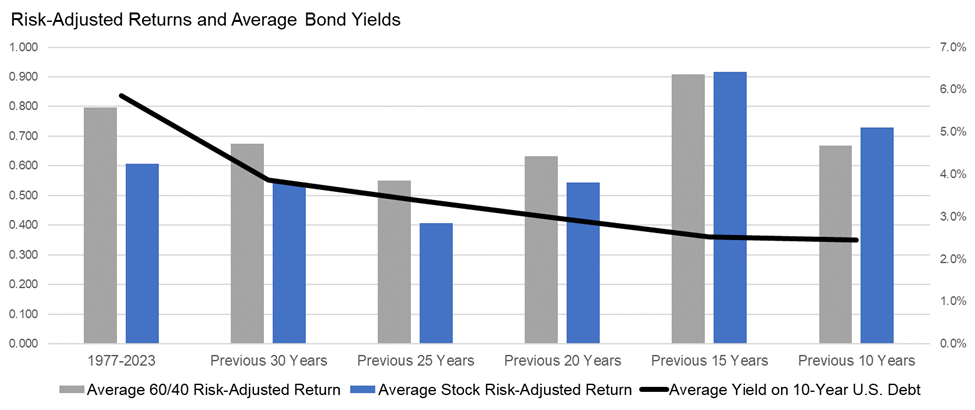

Investors can once again earn income on the fixed income portion of a balanced portfolio. Most refer to a “balanced portfolio” as one combining some percentage of stocks with a percentage of fixed income assets with weights depending on investor risk and return goals. The typical balanced portfolio, which is often referenced, has around 60% stocks and 40% bonds. The idea behind a balanced portfolio is the combination of stocks and bonds over long periods of time should add diversification benefits through the added income and lower volatility of bonds during periods of stock market volatility.

Since 1977, the stock portion specifically returned 9.6% per year. However, the balanced portfolio returns had a standard deviation of 10.5% while the stock returns had a standard deviation of over 15%, meaning the balanced portfolio had a much higher risk adjusted return. If you run the same test for the previous ten years, the results are very different. Bonds returned around 1.7% per year, so the balanced portfolio did not receive much help from the fixed income allocation. The risk adjusted return is much lower for the balanced portfolio than the broad stock market in this scenario. This return differential is largely due to low interest rates caused by central banks holding rates close to zero. The further out we look, the better the risk adjusted returns are for a balanced portfolio versus the broad stock market. This condition is because, the further out we look, the more periods of historically normal interest rates are captured by fixed income assets which assists in higher returns and lower volatility for the balanced portfolio.

We include a chart below which overviews the risk-adjusted return for a balanced portfolio and the stock market across different time periods and show the average yield on 10-Year U.S. debt (which can be used as a proxy for average bond yields). This chart shows we can be much more optimistic about balanced portfolio performance when fixed income yields are closer to their long-term average.

3.The Return of Active Management and the Importance of Fundamentals

Opportunity cost should be one of the primary considerations of any financial or investment decision. Low interest rate environments cause the interest earned on savings/cash to be minimal. For the decade or so pre-Covid, it was zero in the U.S. and negative in some countries. This essentially made taking riskier investments with cash a much easier decision. From a theoretical standpoint, the value of any asset should be equal to the discounted present value of its future cash flows. This discount rate used in theoretical frameworks can essentially be looked at as the opportunity cost of investing. The lower the rate at which future cash flows are discounted, the higher the present value of an asset’s future cash flows. This relationship speaks to why we often see a negative correlation between interest rates and the valuation on the broad stock market. When interest rates fall, the valuation multiple, which investors will typically pay for a riskier asset, such as stocks, goes up.

Artificially low interest rates lowered the opportunity cost bar for other assets, and thus artificially lifted asset valuations across the world. Coincidentally, when interest rates were pushed higher post-Covid, there was a large valuation reset needed. In our opinion, today’s position is much different. While this situation took some short-term pain, it is ultimately a good factor for long-term investors, as it should lower the appetite for speculative investing and should prohibit as much risk taking from market participants. From our perspective, an important factor of successful investing in the stock market during this period will be a refocus on company fundamentals such as earnings, margins, and company management. The previous decade didn’t always favor these factors over more speculative companies with earnings expected to come further out in the future. However, we think the next decade will be kind to investors who focus on buying very high-quality companies at attractive valuations.

4. Opportunistic Ideas/Considerations

The volatility and dispersion across asset class returns over the last one to two years has created interesting opportunities for investment. Alongside our theme of taking a balanced view of the world, and the big picture of financial markets, Acumen believes it is important portfolios continue to take advantage of opportunities.

For instance, we continue to believe Emerging Market (EM) equities present an attractive opportunity for investment. Emerging Market stocks have lagged U.S. stocks over the last decade, and relative valuations are near historic lows. Additionally, in our opinion specific countries could stand to benefit from shifting and diversifying supply chains in response to what occurred during the pandemic. The U.S. dollar has persistently increased over the last decade and been a headwind to EM assets, though we think this headwind could dwindle over the next several years. Finally, we prefer to express this viewpoint in client portfolios through active management to find the best opportunities in EM.

We are convicted the U.S. Treasury yield curve will re-steepen. Short-term interest rates are currently higher than long-term interest rates. This situation is referred to as an inverted yield curve and is abnormal. Typically, inverted yield curves do not last for more than a year or two. Across each macro-economic outcome that may occur in 2024, we believe the treasury yield curve is likely to re-steepen, meaning long-term rates will move higher than short-term rates. Because of this steepening, we think portfolios should have a strategic allocation to short duration bonds.

Overall, we believe investors should stay optimistic since there are always opportunities presented within financial markets. Today, it is difficult to be convicted on one macro-economic outcome, but we feel our risk-first opportunistic approach will allow us to find those opportunities and create beneficial outcomes for clients.

Sources and References

- “Easy Money”, Howard Marks, Oaktree Capital Management, 9 January 2024

- “Stocks” refers to an S&P 500 Index Fund

- “Bonds” refers to a Bloomberg Barclays U.S. Aggregate Index Fund

Information and charts used in this commentary were obtained via Bloomberg L.P.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. The views and strategies described may not be suitable for all investors. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. Investments in securities involves risk, will fluctuate in price, and may result in losses. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness.

This communication may contain certain opinions and “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. All such opinions and forward-looking statements are conditional and are subject to various factors, including, without limitation, general and local economic conditions, changing levels of competition within certain industries and markets, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors, any or all of which could cause actual results to differ materially from projected results.

Any charts, graphs, and descriptions of investment and market history and performance contained herein are not a representation that such history or performance will continue in the future or that any investment scenario or performance will even be similar to such chart, graph, or description.

Acumen Wealth Advisors, LLC® is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Acumen Wealth Advisors, LLC® and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Acumen Wealth Advisors, LLC® unless a client service agreement is in place.