Q4 2023 Commentary

It is hard to believe we are nearing the end of 2023. As the leaves change color and the air turns crisper, it’s not just the seasons that are evolving. We are going to walk through what’s changing (and not changing) in the macroeconomy and financial markets. What has certainly not changed is our care for your investment portfolio. It is important to always keep us informed and let us know if there are any changes that could affect your financial situation and investment objectives.

U.S. Economy

The consensus in the beginning of 2023 indicated a recession would occur. Many people were referring to a possible downturn as “the most anticipated recession of all time”. Starkly negative leading economic indicators, a repricing of the cost of debt (interest rates) to a much higher level, and a large amount of geopolitical uncertainty across the globe contributed to this viewpoint.

The global economy has seemingly avoided a recession to this point. There are plenty of contributing factors to the resilience in the economy, and chief among them has been the strength of the labor market. For most of the past 12 months, there have been 1.5 open jobs per unemployed person. Wage growth has also remained high relative to history. Essentially, jobs have been plentiful, claims for unemployment insurance have hovered near historical lows, and workers have been making more money. Economic strength can also be attributed to people feeling wealthier as their asset bases have generally appreciated post-COVID, excess savings from the pandemic, and fiscal stimulus such as furloughed student loan repayments.

The strength in the economy, coupled with some continued supply pressures, has left inflation stubbornly above the Fed’s long-term target rate of 2%, and validated continued hawkish monetary policy. In our opinion, there has been a large disconnect between what the Fed has said they would do and what market participants expected them to do. While the Fed has continuously reiterated their target short-term interest rate would remain higher for longer, market participants at one point this year were pricing in dramatic rate cuts over a 12-month period. Ultimately, various narratives took a stranglehold on the market throughout the year, and investors consistently flipped from believing in a soft landing, to a hard landing, to a no landing, multiple times throughout 2023.

This narrative game played by market participants during the first nine months of 2023 led to some volatile price action across asset classes. From January through July, the S&P 500 was up nearly 20% while longer bond yields were relatively flat. Shorter-term yields continued to climb. August and September were a different story as stocks struggled and we saw the largest monthly rise in the 10-year United States Treasury Yield since September 2022. This upside volatility in Treasury yields brought volatility to equity markets, and the strong momentum from the beginning of the year faded. The broad stock market was down more than 5% from 7/31/2023 to 10/12/2023. There are a few reasons interest rate volatility has been reintroduced to the market, but we would broadly attribute the rise in yields to a supply/demand imbalance, and the market finally digesting the Fed’s higher for longer narrative. Renewed geopolitical tensions in the Middle East also likely contributed to volatility over the last month or so.

What is clear now, in our opinion, is the Fed is getting what it wanted – tighter financial conditions. Some Fed-speak in recent weeks has indicated a lesser need for additional interest rate hikes if financial conditions appear tight enough. The real Fed funds rate (the Fed funds rate less inflation) is now positive, and other measures of financial conditions have pointed towards recent tightening in the monetary system. While the appropriate level of restrictive monetary policy is unknown, broad macroeconomic signals remain incredibly mixed. Leading indicators continue to point to a contraction in the business cycle, student loan repayments are being reintroduced to the economy, the labor market has shown signs of loosening, and geopolitical pressures persist.

Our short to medium-term viewpoint calls for caution. Additionally, we believe the post-COVID decade will look much different from the decade pre-COVID. While the pre-COVID decade was marked by globalization, low inflation, and low interest rates, we see a high probability of a continued reversal in those trends over the next decade. All of these changes create tremendous opportunity to shift exposures for potential portfolio growth.

Equities

Much like the global economy, the broad equity market has been stronger than expected throughout the year. However, performance varied widely. While the S&P 500 Market Cap Weighted Index was up 13% from 12/31/2022 to 9/30/2023, the S&P 500 Equal Weighted Index was only up approximately 1.5% which points to a large dispersion in performance across the stock market. This bifurcation in performance has been driven by a handful of mega cap tech stocks inspired by the Artificial Intelligence narrative. Roughly ten companies within the S&P 500 have contributed to more than 80% of the index’s total return for the year.

Importantly, in our opinion, much of the positive performance in the stock market has been driven by higher valuation multiples. Since 9/30/2022, the S&P 500 is up 22%, and can be completely attributed to an increase in what market participants are willing to pay for stocks, as earnings expectations have remained relatively flat. Today, based on most conventional measures, the broad stock market appears overvalued. This type of expansion in valuation multiples for the stock market is abnormal, given the rise in bond yields. Historically, higher bond yields have proven to be a headwind for stock valuations, as investors are less willing to pay for an expensive risky asset while relatively risk-free assets like United States Treasuries yield 5% or more. Dispersion can also be seen in valuations. Many stock market sectors are trading at or below their long-term average valuation. International Developed and Emerging Markets equities are two other areas which appear to have more attractive valuations.

Ultimately, the source and bifurcation of stock market performance leads us to two primary convictions within our management of equity portfolios.

- While the equity market has exhibited upwards momentum on the surface, a deeper analysis points to the fact positive performance has been heavily influenced by a few stocks. This concept is not indicative of overall economic strength. Small- and mid-cap stocks, as well as various sectors within the equity market, are either flat or down year to date. These areas of the market show more of a mixed picture of the economy, coupled with the view we laid out in our macro section above.

- The role of active management will be in much greater focus over the coming decade. The rise in global bond yields reintroduces a hurdle rate to investment and will bring forth a greater emphasis on valuations and fundamentals within stock market investing. Periods of large dispersion within performance and valuations, as explained above, further support this viewpoint.

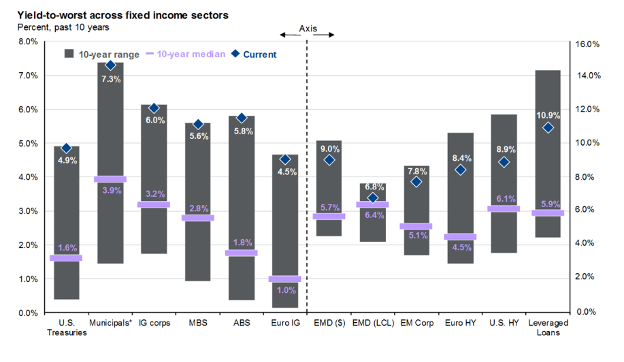

While we believe maintaining exposure to equities is important for long-term portfolio growth, because of the points laid out above, we maintain a relatively defensive approach to investing in stocks today but place a large emphasis on identifying opportunities. This approach emphasizes the selection of high-quality companies and active management across equity market sectors and styles. As detailed above, there are areas to get excited about in the equity market beneath the surface. As a result of the broad equity market’s lofty valuation, there is strong relative value across the fixed income market, and one component of our modestly defensive positioning is the availability to add lower risk investments currently yielding between 5% and 6% to client portfolios.

Fixed Income

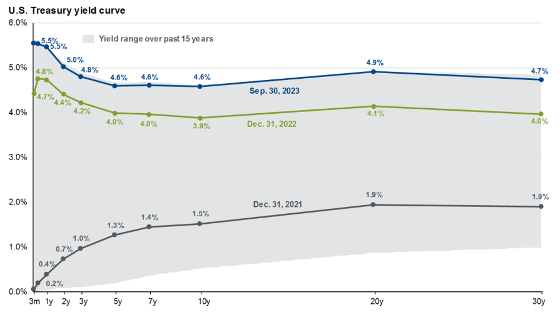

As we’ve detailed in past letters, the Fed has embarked on one of the most restrictive monetary policy efforts ever seen – causing interest rates and bond yields to rise incredibly fast throughout 2022, and at a slower pace (but still upward!) year-to-date. Recall bond prices are interest-sensitive and the price of a bond will move inversely with the direction of interest rates. This means, as rates rise, bond prices will fall. For example, when the Fed raised interest rates by over 4% in 2022, the Bloomberg Aggregate Bond Index was down -13%. Year to date, the same index is down roughly -2% at this time, as interest rates continued to rise this year, but at a much slower rate than in 2022. As shown directly below, the Fed raised the Federal Funds rate another 1% to the current range of 5.25% to 5.50%. As a result of higher interest rates, bond yields remain around the highest in almost 20 years (shown below) and we believe they provide an excellent risk-adjusted investment opportunity to add the potential for returns of >5% from lower risk assets.

Source: JPM Morgan, data as of 9/30/23

Source: JPM Morgan, data as of 9/30/23

While bond prices will move down as rates rise (and move up as rates fall), it is important to note the return on a bond is effectively “locked in” at purchase. Thus, with higher yields in today’s environment, we are able to “lock in” higher yields on any new bonds we purchase in client portfolios and hold to maturity (assuming those bonds do not default, which is very low probability given the high-quality bonds we target). For many clients, we attempt to mitigate interest rate and reinvestment risk with the use of bond ladders, whereby we are constantly reinvesting maturing bonds and investing over a 2- to 12-year period and attempting to minimize reinvestment risk in any one given year.

As we have mentioned, as rates continue to rise, we saw a broad pullback in bond prices (though much less than 2022). While bond price performance may not end the year “in the black,” we believe the risk-adjusted return from adding income-based returns of more than 5% on extremely high-quality bonds is highly attractive and offers strong relative value when compared to higher risks (and in some cases, expensive valuations) in equities. Thus, we remain marginally overweight to fixed income. Importantly, we have also continued to maintain positions in short-term treasuries which offer attractive yields and provide “dry powder” in the event we see a buying opportunity in riskier assets at some point during the next 12 months.

Closing

In summary, we see reason for caution in the near term as the impacts from the higher cost of capital continue to move through consumer and business balance sheets as well as financial markets. However, we remain focused on maintaining core exposure to the appropriate mix of equities, fixed income, and alternatives for our clients’ specific risk profiles and long-term growth goals. We aim to balance these long-term goals with our near-term cautious outlook by taking advantage of strong yields in lower-risk assets, looking for attractively priced risk assets, and setting up to deploy marginal capital when opportunity arises.

Feel free to reach out to us with your thoughts, questions, or suggestions; we always enjoy hearing from you.

Invest Intentionally®,

Your Acumen Wealth Advisors Team

Information used in this commentary was obtained via Bloomberg L.P.

The opinions expressed in this commentary should not be considered as fact. All opinions expressed are as of the published date and are subject to change. Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. Investments in securities involves risk, will fluctuate in price, and may result in losses. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation. Comments concerning the past performance are not intended to be forward looking and should not be viewed as an indication of future results. Diversification does not protect against loss of principal.

This communication may contain certain opinions and “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. All such opinions and forward-looking statements are conditional and are subject to various factors, including, without limitation, general and local economic conditions, changing levels of competition within certain industries and markets, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors, any or all of which could cause actual results to differ materially from projected results.

Acumen Wealth Advisors, LLC® is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Acumen Wealth Advisors, LLC® and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Acumen Wealth Advisors, LLC® unless a client service agreement is in place.