Recent Changes to Retirement Plans and Tax Laws

In the past eight months, multiple changes have been made to tax law through the SECURE Act as well as the CARES Act. These changes are the most sweeping retirement account reforms made in recent history and Acumen’s financial planners have been diligently watching and incorporating these changes into strategies as they may provide long-term tax benefits and planning opportunities for a majority of our clients.

SECURE Act

- Age to Begin Required Minimum Distributions Extended – Previously, the age which an individual was required to take Required Minimum Distributions (RMDs) from a retirement account or plan was 70½. The new age to begin RMDs is now 72. Those who turned 70½ in 2019 must keep taking RMDs according to the rules prior to the passage of the SECURE Act.

- IRA Contributions can be Made Past 70½ – Individuals who have earned income or individuals whose spouses have earned income are now eligible to contribute to an IRA no matter what age they are.

- Some Part-Time Employees Eligible for 401(k) – Part-time employees who have worked at least 500 hours each year for three consecutive years and are 21 and older may be eligible to make 401(k) contributions and deferrals. This eligibility is contingent upon plan provider.

- Stretch IRA Provision Eliminated – Some non-spousal beneficiaries will now have to deplete the balance of an inherited IRA within ten years. Exceptions to this rule include:

- Those who inherited a retirement account from a benefactor who passed before December 31st, 2019;

- Surviving Spouse;

- Minor Child (until they reach the age of majority);

- Beneficiary who is disabled or chronically ill;

- Beneficiary who is ten years younger or less than the IRA or plan owner.

- Penalty-Free Withdrawals from Retirement Plans for Childbirth or Adoption – Each parent can take a $5,000 penalty-free withdrawal from their retirement plan for expenses associated with childbirth or adoption. This new benefit means married couples can withdraw a combined total of $10,000. It is important to note any withdrawal will be taxable as income.

- 529 Plans Can Be Used for Student Loan Repayment – 529 plans can now be used to pay a maximum of $10,000 towards student loan repayments. This lifetime amount is for the 529 plan beneficiary, but an additional $10,000 lifetime amount can be used for the sibling(s) of a beneficiary.

CARES Act

- Penalty-Free COVID-19 Retirement Plan Withdrawal – Qualified individuals, whose health or financial situation has been affected by COVID-19, can make a penalty-free withdrawal from an eligible retirement plan up to $100,000 or take a loan up to 100% of their vested balance if the plan provisions allow. The IRS has set guidelines as to who qualifies for this withdrawal, taxability of this withdrawal, and repayment stipulations HERE.

- 2020 RMDs are Waived – Individuals are not required to take RMDs for 2020 from 401(a), 401(k), 403(a), 403(b), governmental 457(b) plans, and IRAs. This RMD waiver also applies to inherited IRAs but not to defined benefit plans.

- 2020 RMDs Already Taken Can Be Rolled Back In – When the CARES Act was first passed, those who had already taken their 2020 RMD earlier in the year had 60 days from the date of distribution to roll those funds back. The IRS now allows for RMDs taken at any point in 2020 to be rolled back into a retirement account as long as this transaction is done by August 31st, 2020.

- Tax Deadline Extension – The new deadline to file and pay taxes is July 15, 2020. This date is also the deadline to make 2019 IRA or Roth IRA contributions.

Other Relief

- Tax Deadline Extension for Victims of April Tornadoes – Victims of the April tornadoes, severe storms, and flooding in Mississippi, Tennessee, and South Carolina will have until October 15th, 2020 to file their individual and/or business tax returns and make tax payments. All residents, not only victims, of certain counties are eligible for this extension, including Hamilton County, Tennessee. The information can be viewed HERE.

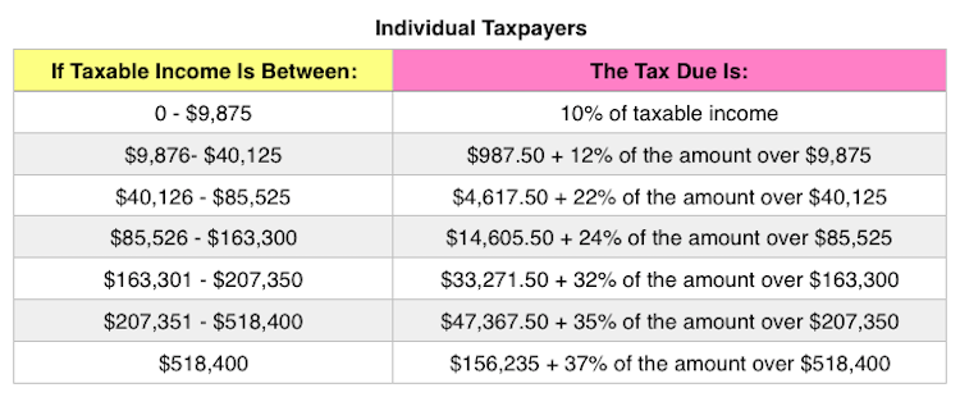

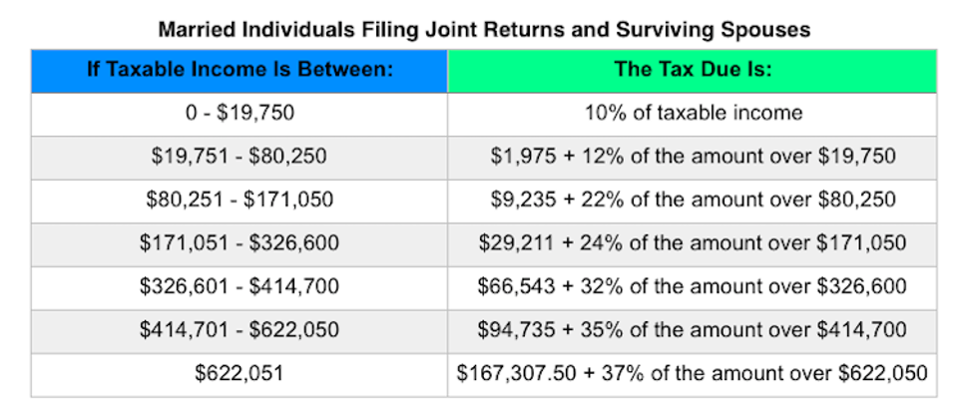

In addition to these reforms, the income brackets for tax rates have been updated for 2020:

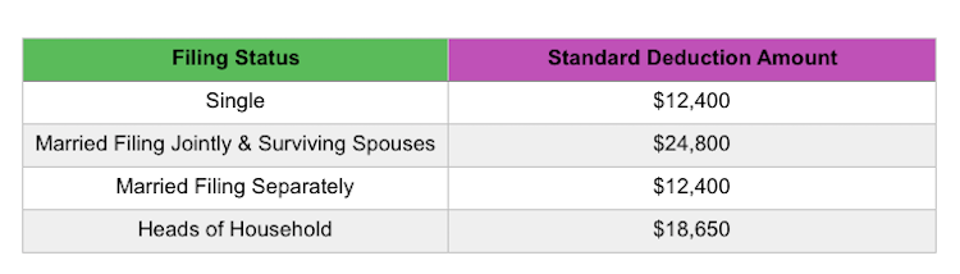

The standard deduction amounts have changed as well:

*There is an additional standard deduction of $1,300 for taxpayers who are age 65 or older and/or legally blind. A married couple filing jointly may be able to claim $2,600 in additional standard deduction. Unmarried taxpayers and those filing as head-of-household who meet these same conditions can claim $1,650 in additional standard deduction.

This is not a comprehensive list of changes but include pertinent changes for individuals taxpayers.

Earlier this year, Acumen wrote an article regarding the benefits of a Roth IRA, the Roth conversion process, and how this may be an opportune time for the strategy HERE. The benefit of Roth conversions may be increased with some of these changes:

- The extension of the RMD age allows more years of Roth conversions before additional income through RMDs must be recognized.

- The waiver of 2020 RMDs allows those in a high tax bracket to “replace” their 2020 RMD income with Roth conversion income without encroaching on a higher tax rate.

- The elimination of the “stretch” IRA can create accelerated tax burdens for beneficiaries of a traditional IRA.

We encourage you to speak to one of the planning professionals at Acumen Wealth Advisors if you believe you may benefit from any of these changes or you believe a Roth conversion is beneficial for your long-term financial plan.

To learn more about how Acumen can help you Invest Intentionally®, please contact us.

The opinions expressed in this commentary should not be considered as fact. All opinions expressed are as of the published date and are subject to change. Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. Investments in securities involves risk, will fluctuate in price, and may result in losses. The information has been obtained from sources we believe to be reliable; however, no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation. Comments concerning the past performance are not intended to be forward looking and should not be viewed as an indication of future results. Diversification does not protect against loss of principal.

Acumen Wealth Advisors, LLC® is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Acumen Wealth Advisors, LLC® and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Acumen Wealth Advisors, LLC® unless a client service agreement is in place.