Retirement Plan Fees

Retirement plan fees are complicated. Between administration, investment management, recordkeeping, consulting, revenue sharing, sub-TA and 12b-1, it isn’t always clear to plan participants or plan sponsors exactly what they’re paying, how much they’re paying or even who’s paying the fees.

ERISA Section 408(b)(2) states that plan fiduciaries have to determine whether the agreements and compensation of service providers are “reasonable.” The rule requires service providers to supply plans with disclosures to help them determine if fees are “reasonable.” Acumen Wealth Advisors, LLC® helps fiduciaries with this complicated determination by identifying:

- All of the total plan cost components

- The various primary drivers of retirement plan pricing

- The role of revenue sharing

Cost Components

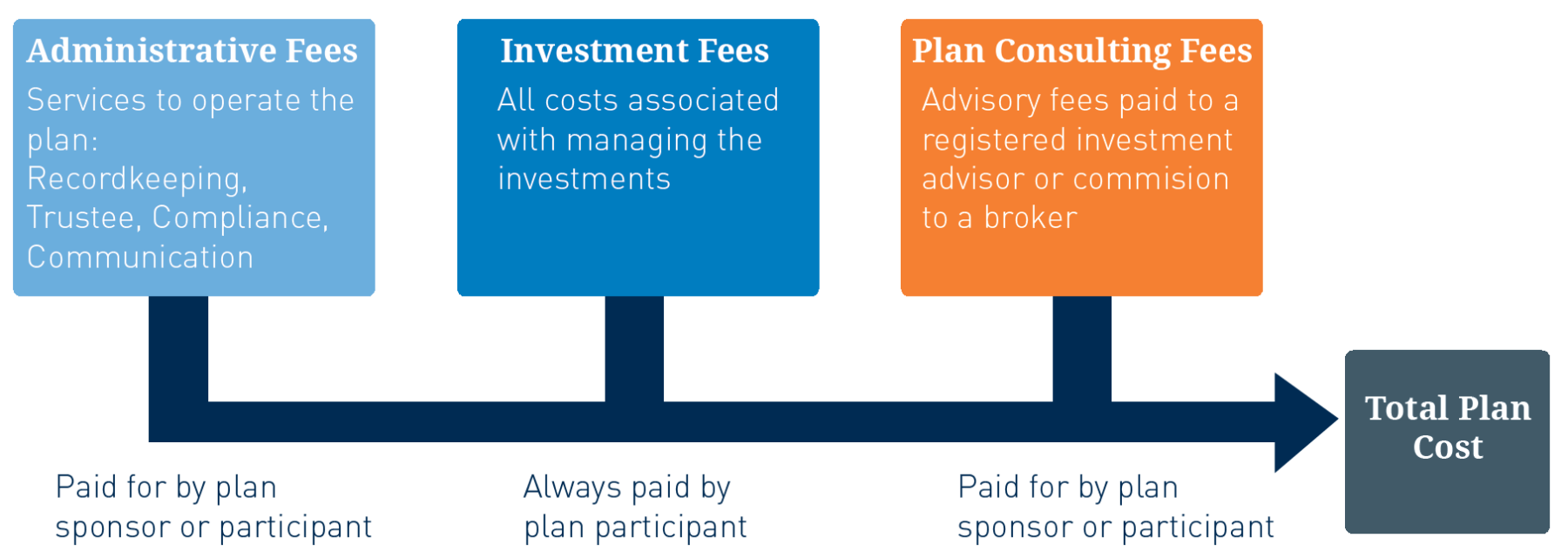

The three main components are administrative fees, investment fees and plan consulting fees. Administrative and plan consulting fees may be paid by the plan sponsor or the participant. Investment fees are always paid by participants and deducted from plan assets.

Primary Pricing Drivers

Several key factors can impact plan pricing. The larger the plan in terms of assets, the lower the plan sponsor out-of-pocket (per participant) costs. Other factors to consider include:

- Number of plan participants

- Average account balance

- Service requirements

- Plan design features

Revenue Sharing

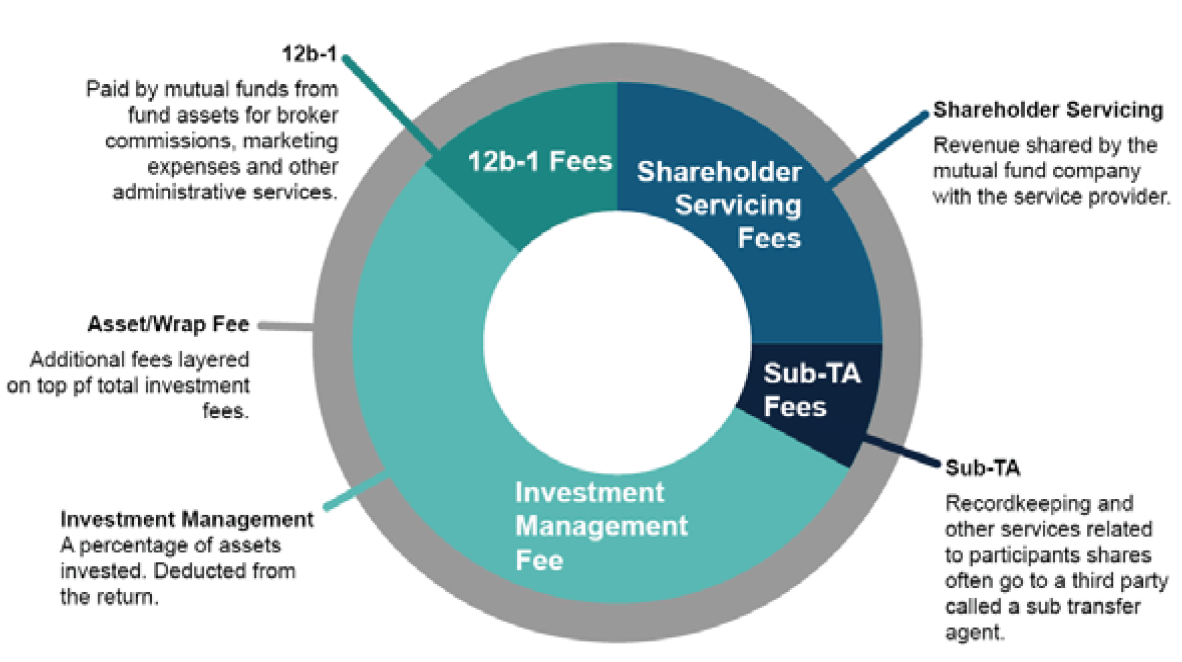

Revenue sharing includes payments made by investment managers to service providers or plan consultants for a portion of the revenue generated from the management of a particular fund or funds. Historically, such allowance may or may not be known to a plan sponsor. Regardless, it’s imperative that plan sponsors with fiduciary oversight of their organization’s retirement plan understand the distribution systems that most investment management organizations use and how they share revenue.

The most common forms of revenue sharing can include 12b-1 fees, shareholder servicing fees and sub-transfer agent (sub-TA) fees. In some instances, a portion of the investment management fee for proprietary funds may include some revenue sharing. The diagram below illustrates potential fund expenses.

Fiduciary Best Practices

Best practices dictate that plan fiduciaries must go through a prudent, comprehensive and measurable process of monitoring and documentation to ensure that only reasonable fees are being paid. This process includes:

- Working with an experienced consultant who understands retirement plan fee components

- Disclosing and documenting all fees from retirement plan service providers

- Benchmarking fees annually for due diligence purposes

- In-depth, live-bid benchmarking of fees, services and investments against alternative provider every three years to ensure competitive reasonableness

Mutual funds are sold by prospectus only. Before investing, investors should carefully consider the investment objectives, risks, charges and expenses of a mutual fund. The fund prospectus provides this and other important information. Please contact your representative or the Company to obtain a prospectus. Please read the prospectus carefully before investing or sending money.

Acumen Wealth Advisors, LLC® is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Acumen Wealth Advisors, LLC® and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Acumen Wealth Advisors, LLC® unless a client service agreement is in place. Acumen Wealth Advisors, LLC® is affiliated with RPAG and utilizes their robust retirement plan consulting tools and resources to deliver enhanced value to plan sponsor clients. RPAGTM, a wholly owned subsidiary of NFP (NFP Corp.), provides retirement advisors premier technology, systems, training, and resources through its practice management platforms.