Silicon Valley Bank Commentary

* These developments are quickly unfolding. This article was composed less than 24 hours ago but since this was drafted… the Fed has created a backstop like the one mentioned as the most probable solution in the article below.

Who is Silicon Valley Bank?

Until recently, many people may not have heard of Silicon Valley Bank (SVB). This large regional bank has made their specialty working closely with technology companies and venture capital (VC) firms. According to their website, they are based in Santa Clara, CA, and brand themselves as “financial partner of the innovation economy.”

- Silicon Valley Bank is ranked the 16th largest US bank by Assets[i]

- More than 85% of Silicon Valley Bank’s deposits were not FDIC insured[ii]

- As a state-chartered bank, it was regulated by the California Department of Financial Protection and Innovation (DFPI) and was a member of the Federal Reserve System[iii]

What happened?

Last Friday, Silicon Valley Bank fell into receivership with the Federal Deposit Insurance Corporation (FDIC) after a run on the bank. A “run on a bank” happens when depositors take money out of the bank, and it exceeds the bank’s ability to give depositors their cash because the cash is either loaned out or otherwise invested in something which has lost value. The regulators cited “inadequate liquidity and insolvency”. Receivership typically means a bank’s deposits will be assumed by another, healthy bank or the FDIC will pay depositors up to the $250,0000 insured limit.

The issue escalated for SVB when they announced a $2 billion capital raise after taking a loss on a portion of their investment portfolio. Bank accounting standards do not always require banks to post losses on bonds on their financial statements. It is not necessary problematic to hold investments at the value at maturity. In periods of falling interest rates, it helps prevent banks from overstating the value of these securities. It becomes an issue when losses must be recognized to cover withdrawals from depositors. In this case, the bank had to recognize the losses on poor performing bond investments as they were recently liquidated to meet deposit obligations.

When it became evident to investors, depositors, and Wall Street what had happened, customers started requesting their money. A run on the bank ensued and the stock price dropped more than 60% in one day.

How did this happen?

Banks hold a portion of their deposits in a portfolio of typically low-risk investments such as Treasuries and mortgage-backed securities. In this case, it means a low risk of default. After 2008, regulatory bodies forced banks to keep a liquidity ratio of at least 100% – meaning all liabilities must be covered by assets. There is another risk to these assets which is called duration risk (how long bonds are invested); and it is exacerbated in bank financials when there is a mismatch in the length of time a bank depositor need their deposits and the amount of time the bank locked in those deposits in securities like bonds.

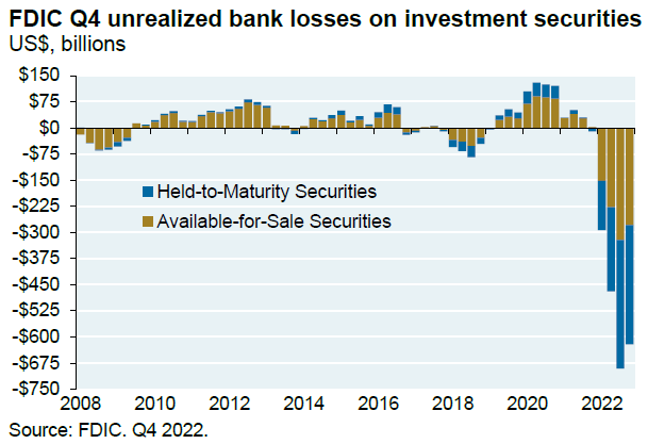

Yields and bond prices work in an inverse relationship. This relationship means, as bond yields rise, the market value of a bond or bond portfolio typically falls. Because of their inverse relationship, and the bank’s choice to invest ay low rates (for a long time) a few years ago, when there was much more capital, the rise in interest rates and yields has generated large unrealized losses in banks’ holdings of Treasuries and Mortgage-backed Securities.

At the same time, customers started pulling deposits from the bank last year for two reasons. One, banks have seen large outflows as depositors have realized they can generate much higher interest by owning treasuries or other high quality fixed income investments. Banks are just now beginning to raise interest rates paid on checking, savings, and other deposit accounts, and still are not paying attractive rates relative to seemingly risk-free bonds. Additionally, specific to SVB, their client base was incredibly concentrated in venture capital – both investment funds and startups. Venture capital fundraising dried up over the last couple of years, exaggerating the outflow of deposits for the bank. Ultimately, SVB was forced to realize previously unrealized losses.

While most banks saw a sharp increase in deposits post-COVID, SVB’s increase was even more exaggerated with so much money flowing to the venture capital space. The CFO warned analysts on their 4Q 2021 earnings call that the Fed would likely move fast the following year to raise interest rates, but they were confident the VC sector would continue to grow. This was not true as the rapid rise in interest rates the following year halted a large amount of capital flow to the sector – typically, known as one of the riskier asset classes.

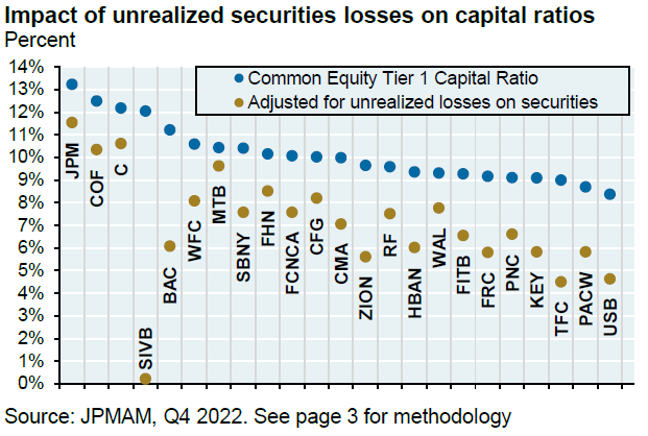

In our opinion, the bank clearly mismanaged and mis-hedged its interest rate exposure. As deposits grew in 2021, the bank poured money into fixed income securities with rates at historically low levels and despite concerns of a Fed interest-hiking cycle. The bank held close to 70% of their deposits in these types of securities (Bloomberg, Cameron Crise). For comparison, the average bank in the KBW Bank Index is a little more than 30%. By the end of 2022, SVB was sitting on a massive pile of low-yielding securities with an unrealized loss of around $15 billion. Meanwhile, the bank was not working enough to hedge their interest rate exposure like most banks do. Silicon Valley Bank’s strategy was not prudent even for the best of times which can be made even more disastrous when your primary clientele has a high cash burn rate and is itself vulnerable to rising interest rates.

What will happen?

It is more than fair to say large losses in bonds and a flight of customer deposits are creating new risks for U.S. banks. Investors and depositors are now questioning whether SVB’s troubles are isolated or systemic. We view SVB’s issue as an extreme case but remain cautious about the financial sector as a whole – specifically, small, and regional banks who are more exposed to this dynamic.

Currently, regulators are seeking a buyer of SVB assets. The FDIC aims to find buyers and return as much of clients’ money as possible. Additionally, the FDIC and Federal Reserve are weighing the creation of a fund which would allow regulators to backstop deposits at banks that run into trouble. There is a pathway to this arrangement, as it would be very similar to the Troubled Assets Relief Program (TARP) that was created during the great financial crisis. Worthy of note, in December 2013, the Treasury wrapped up TARP and the government concluded its investments had earned more than $11 billion for taxpayers. To be more specific, TARP recovered funds totaling $441.7 billion from $426.4 billion invested[iv].

The Acumen investment team believes, using such a mechanism, is critical to restoring confidence and would reassure deposits in other banks and calm panic. Ultimately, we believe this will happen and there is not a threat to our financial system as in 2008. The main goal will be to protect the depositors of the banks. The idea of letting a business fail, not for any legitimate business reason, but for the failure of one bank, is unconscionable since many of the companies banking at SVB are innovative companies which will advance our country’s technology over the next decade. At first, the problems, faced by Silicon Valley Bank, appeared to many to be systemic although they actually are very specific to the bank itself. Bank runs in any fashion are damaging, but SVB was unusually vulnerable to the system we have experienced post-COVID.

How are we dealing with this?

First of all, rest assured the Acumen portfolio management team is monitoring the situation unfolding with SVB and the financial sector. While we primarily believe this was a SVB-specific issue, we also believe it will introduce more volatility to the financial sector as a whole. Across client portfolios, we are underweight to financial stocks, specifically, and even more so, to banks before the situation unfolded. What bank exposure we do have in portfolios is allocated to large high-quality banks which are materially more safeguarded from these dynamics. They have a much more diverse clientele, hedge their interest rate exposure, and make money from various avenues.

Additionally, we continue to take a very guarded approach to the current market environment. While risk assets rallied from October 2022 until February 2023, we remained skeptical of the notion market volatility is over. As a result, we have continued to invest assets into areas we believe will provide income, diversify from equity market risk, and protect portfolios on the downside.

This is, of course, an incredibly dynamic situation, and we will update clients if our outlook changes. We are also available to answer any questions you may have.

[i] (Federal Reserve’s statistical release as of 12/31/2022)

[ii] Time Magazine

[iii] Federal Deposit Insurance Corporation. March 3, 2023.

[iv] Investopedia, Troubled Asset Relief Program (TARP), What It Was, How It Worked. September 2020.

v “Silicon Valley Bank Failure”, Eye on the Market. JP Morgan.

The opinions expressed in this commentary should not be considered as fact. All opinions expressed are as of the published date and are subject to change. Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. Investments in securities involves risk, will fluctuate in price, and may result in losses. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation. Comments concerning the past performance are not intended to be forward looking and should not be viewed as an indication of future results. Diversification does not protect against loss of principal.

Acumen Wealth Advisors, LLC® is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Acumen Wealth Advisors, LLC® and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Acumen Wealth Advisors, LLC® unless a client service agreement is in place.